In a stunning turn of events, Elon Musk, the billionaire CEO of Tesla and SpaceX, has seen a jaw-dropping $44 billion vanish in a matter of hours. The sudden loss has sent shockwaves throughout the global markets, leaving investors, analysts, and industry observers scrambling to understand what caused such a massive devaluation and what the future holds for Musk's empire.

This article delves into the aftermath of this crisis, exploring the series of events that led to the massive financial fallout, its potential long-term consequences, and the steps Musk may take to recover from the crisis. As one of the world’s most influential figures, Musk’s personal and business decisions have ripple effects across industries, economies, and global markets.

Now, as Tesla and SpaceX brace for the aftermath, Musk faces the most difficult challenge of his career.

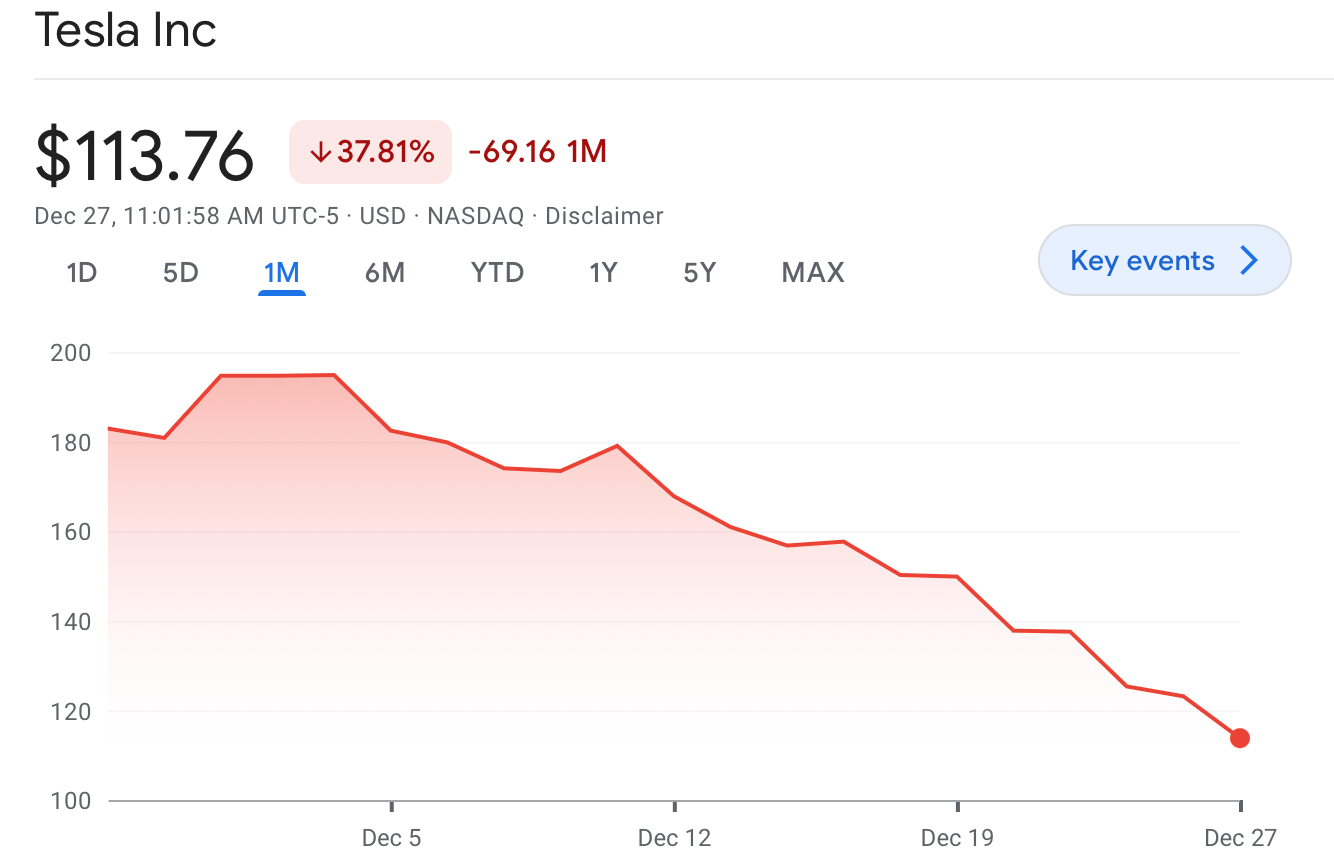

On a seemingly normal trading day, Tesla’s stock price plummeted, resulting in a staggering $44 billion loss in the company’s market value. This dramatic drop came with little warning and sent the stock into a tailspin.

The event has been described as one of the largest single-day losses for any publicly traded company in history, a fact that has captivated the financial world.

Tesla’s stock has long been known for its volatility, with price fluctuations that can swing wildly in a short period. However, the scale of this particular drop has taken even seasoned investors by surprise.

Despite the company’s impressive track record of growth and innovation, this crisis marks a significant moment in Tesla’s history — and in the career of its founder, Elon Musk.

As Tesla’s stock value dipped, other companies within Musk’s portfolio also saw declines. SpaceX, the private aerospace company Musk founded, was also affected by the ripple effects of the crisis.

While SpaceX is not publicly traded and thus not subject to the same scrutiny as Tesla, the company’s dealings with investors and partners have been impacted by the sudden downturn in Musk’s financial standing.

Musk, who has often used his public persona and wealth to shape the future of technology, innovation, and space exploration, now finds himself in the middle of a financial maelstrom. The aftermath of this crisis will not only affect Tesla’s bottom line but could also have significant implications for the future of SpaceX, Neuralink, and The Boring Company — all of which Musk has tied into his broader vision of changing the world.

The sudden and dramatic loss of $44 billion raises the question: What exactly caused this crisis? There are several theories circulating among analysts, each attempting to pinpoint the primary factor responsible for the massive devaluation.

-

Tesla’s Production Challenges: One possible reason for the sharp decline in Tesla’s stock is the company’s ongoing production struggles. Despite having built a reputation for pushing the envelope in terms of innovation, Tesla has faced persistent issues with scaling production to meet growing demand. The company’s Gigafactories in Shanghai, Berlin, and Austin have experienced delays, and the global supply chain crisis continues to affect the production of critical components like semiconductor chips.

While Tesla has made strides in improving its production capabilities, the uncertainty surrounding its ability to meet ambitious production goals could have led investors to lose confidence in the company’s long-term prospects. If production bottlenecks persist, it could hamper Tesla’s ability to capture market share in the increasingly competitive electric vehicle space.

-

Global Economic Instability: Another possible contributing factor to Tesla’s dramatic stock decline is the broader economic environment. The global economy is currently facing a host of challenges, including rising inflation, supply chain disruptions, and geopolitical instability. These factors have contributed to market volatility, affecting not only Tesla but other major tech stocks as well.

As investors become more cautious amid these economic headwinds, companies like Tesla that are reliant on growth and innovation are more vulnerable to sudden shifts in market sentiment. Musk’s personal fortune, largely tied to Tesla stock, also took a hit, further fueling concerns about his ability to navigate this turbulent period.

-

Controversial Actions and Statements by Musk: Elon Musk’s outspoken personality and public statements have often led to fluctuations in Tesla’s stock price. The CEO has been known to make controversial remarks on social media, which can result in sharp movements in the market. Most notably, Musk’s involvement in the Twitter acquisition process has caused some investors to question his focus on Tesla and whether his attention is divided across his various ventures.

In recent months, Musk’s actions related to his purchase of Twitter, along with his sporadic comments on topics ranging from cryptocurrency to politics, have raised eyebrows. Some analysts argue that Musk’s increasingly erratic behavior has contributed to the instability surrounding Tesla’s stock price. Investors may be concerned that Musk’s distractions could interfere with his ability to lead Tesla effectively during such a crucial period.

-

Competition in the Electric Vehicle Market: Tesla has been facing increased competition from both established automakers and new entrants in the electric vehicle market. Companies like Rivian, Lucid Motors, and traditional giants such as Ford and General Motors have ramped up their EV offerings, making it harder for Tesla to maintain its market dominance.

While Tesla remains a leader in the electric vehicle sector, the intensifying competition could have contributed to the market’s growing skepticism about Tesla’s ability to maintain its growth trajectory. As more companies enter the EV space, investors may be recalibrating their expectations for Tesla’s future profitability.

The fallout from this sudden crisis will have far-reaching consequences, both for Tesla as a company and for Elon Musk personally. While the immediate impact has been felt most acutely in the stock market, there are longer-term implications that could shape Musk’s empire for years to come.

-

Tesla’s Financial Health: The $44 billion loss in market value represents a significant blow to Tesla’s financial standing. While the company is still profitable and has a strong cash position, the loss of investor confidence could affect its ability to raise capital in the future. Tesla’s stock price is an important factor in the company’s ability to attract funding for new projects and expansions. As a result, the company may need to adjust its plans for future growth.

-

SpaceX’s Prospects: SpaceX, which has seen success in the private sector with its advancements in space technology and rocket launches, has not been immune to the fallout. Although SpaceX is not publicly traded and is not directly impacted by the stock market, the company relies heavily on private investment and partnerships with government agencies like NASA. A sudden loss of confidence in Musk’s financial standing could make it more difficult for SpaceX to secure funding or form new strategic alliances.

Moreover, Musk’s ability to deliver on ambitious projects like the Starship mission to Mars could be called into question if Tesla’s financial struggles persist. While SpaceX has been a successful venture for Musk, it is not insulated from the broader financial instability that is affecting his other businesses.

-

Musk’s Personal Wealth and Public Image: Elon Musk’s personal wealth is tied closely to the value of Tesla stock. As the market value of Tesla took a nosedive, Musk’s net worth plummeted by a staggering amount. According to estimates, Musk lost as much as $20 billion in just a matter of hours.

Musk’s personal fortune has already been in flux in recent months, due in part to the volatility of Tesla’s stock price and his involvement with Twitter. This latest crisis has only intensified questions about Musk’s ability to balance his multiple ventures while managing the financial health of his businesses. Additionally, the public perception of Musk’s leadership has been affected by the sudden downturn, and the media will be watching closely to see how he handles the aftermath.

Despite the severity of the situation, Elon Musk is no stranger to adversity. The billionaire entrepreneur has faced numerous challenges throughout his career, including early struggles at Tesla and SpaceX, as well as skepticism from Wall Street and the media.

Musk has consistently managed to defy expectations and emerge from difficult periods with new innovations and strategies.

Moving forward, the key to recovery for Tesla and Musk’s other ventures lies in restoring investor confidence. This could involve focusing on improving Tesla’s production capabilities, mitigating the impact of global supply chain issues, and navigating the increasing competition in the electric vehicle market.

Additionally, Musk will need to steer SpaceX through potential funding challenges and continue to deliver on his bold vision for space exploration.

Musk’s personal leadership will play a critical role in determining whether Tesla can bounce back from this crisis. While Musk has a reputation for taking risks and embracing unconventional solutions, it remains to be seen whether his approach will be enough to weather this storm.

Investors and industry analysts alike will be closely monitoring Musk’s next steps as he works to rebuild his empire in the wake of this unprecedented financial crisis.

The sudden loss of $44 billion is a significant turning point for Elon Musk and his companies. The crisis has shaken investor confidence and raised serious questions about the future of Tesla, SpaceX, and Musk’s other ventures.

While the financial impact is undeniable, Musk’s ability to recover and navigate through this challenging period will be a testament to his leadership and resilience.

For now, the future remains uncertain. As Musk confronts the aftermath of this financial crisis, the world will be watching to see how he responds.

Will he be able to regain the trust of investors and secure the future of his companies, or will this crisis mark the beginning of a longer period of instability for Musk’s empire? Only time will tell, but one thing is certain: the road ahead will not be easy.

-1746438127-q80.webp)

-1745550516-q80.webp)

-1745994967-q80.webp)