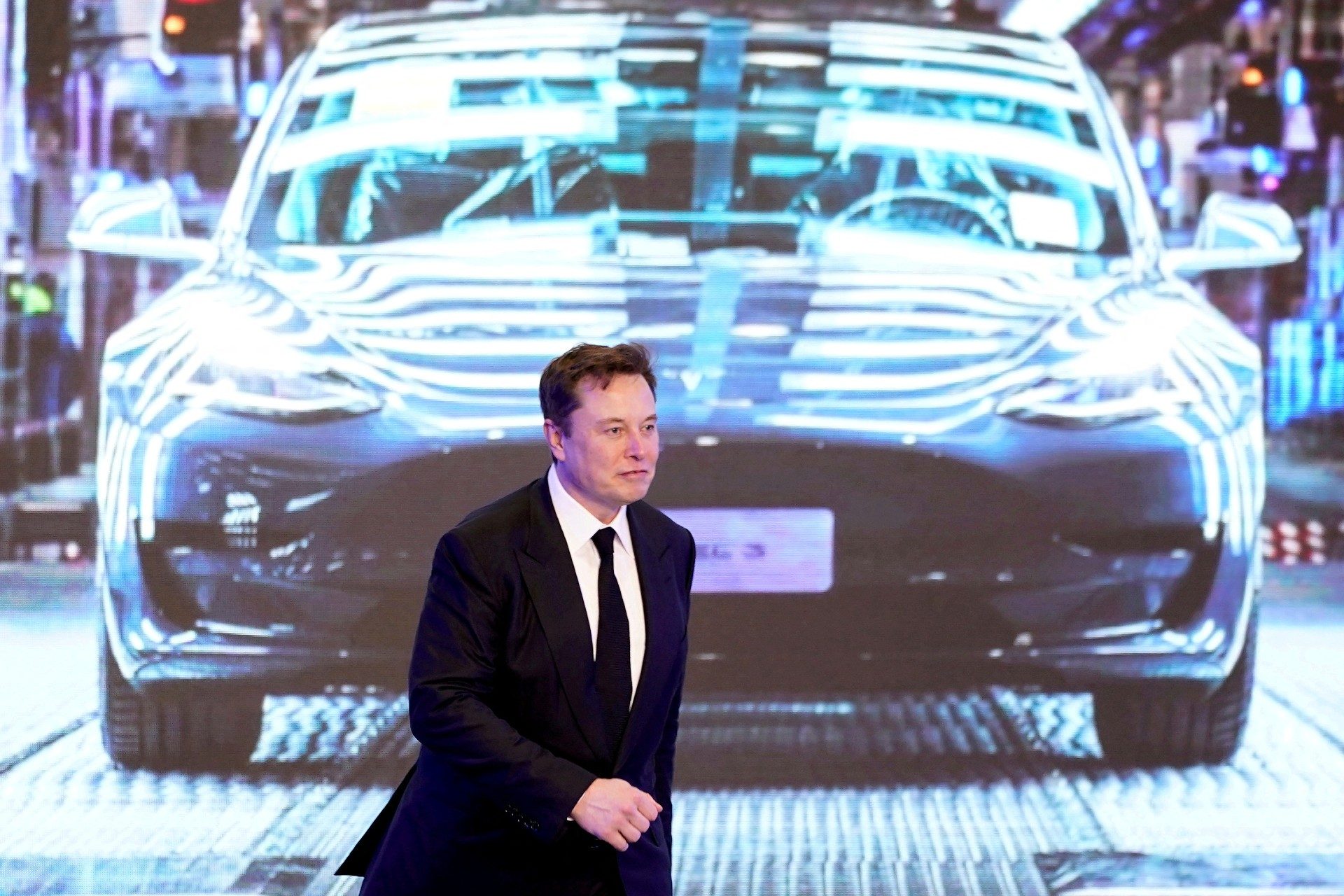

In January 2019, Elon Musk, the charismatic CEO of Tesla, stood alongside Chinese officials at the ceremonial opening of the company's new "gigafactory" in Shanghai. The event marked a pivotal moment in Tesla’s history, symbolizing the company’s bold expansion into China, the world’s largest electric vehicle (EV) market.

Six years later, the Shanghai gigafactory has become an indispensable part of Tesla’s global operations, producing more than half of the roughly 1.8 million vehicles Tesla sells annually worldwide. The factory not only fuels Tesla's growth but also underpins its stock price, cementing Musk’s position as the richest person in the world.

However, this impressive expansion into China comes at a significant cost, one that could spell disaster for Tesla if the ruling Communist Party ever decided to pull the plug. The geopolitical landscape has shifted dramatically, with tensions between the U.S. and China continuing to grow, and Musk’s close association with President Donald Trump has raised eyebrows.

As Tesla’s dependence on China deepens, the potential consequences of a shutdown in Shanghai have never been more pressing.

What would happen if the Chinese government, already at odds with Musk's political ties and willing to leverage its power to achieve geopolitical goals, decided to shut down Tesla’s Shanghai factory? Venture capitalist Prescott Watson, who specializes in electric transportation, puts it bluntly: "I mean, it’s f***ed."

In a worst-case scenario, the ramifications would be catastrophic. "Tesla sales basically go off a cliff by 50 percent overnight… its ability to actually power vehicles built in the U.S. and Europe may go down by a quarter or half. And if you don’t have the power, you can’t really build the vehicles," Watson explains.

The shutdown of Tesla's Shanghai factory would not only cripple the company’s ability to meet demand in its largest market but also wreak havoc on its global supply chain. China, a manufacturing powerhouse, has become indispensable to Tesla’s production capacity, and the loss of this critical asset could result in Tesla facing devastating revenue losses.

Tesla’s reliance on China was not always so profound. When the Shanghai gigafactory was first constructed, the company was still grappling with "production hell" and struggling to scale up its manufacturing.

The decision to build in China was a strategic one, given the country’s remarkable manufacturing capabilities. Unlike Western nations, where constructing a factory and reaching high production volumes can take years, China’s prowess allowed Tesla to build a factory in a year and ramp up production to a million vehicles annually in just two years.

China, in turn, was eager to assert itself as the global leader in electric vehicles, making the partnership a mutually beneficial one. "It’s what allowed Tesla to grow so quickly," Watson says.

As Shanghai-based auto industry consultant Bill Russo puts it, "Tesla is a fast horse that if you allow them to race with the Chinese companies, the Chinese companies will race faster."

The Chinese government’s support was crucial in granting Tesla the opportunity to build its gigafactory, which Musk was allowed to fully own — an extraordinary deal in a country where joint ventures with local firms are typically required. As a result, the collaboration between Tesla and China’s burgeoning EV industry became a powerful force, creating the world’s largest EV market, where Tesla was poised to dominate.

By 2024, Tesla had cemented its position as a dominant player in China, selling nearly 37 percent of its vehicles to Chinese consumers while also manufacturing hundreds of thousands of export models. The Shanghai gigafactory has become an essential hub, not only for local production but also for Tesla’s global operations.

Additionally, Tesla’s decision to open a high-end battery plant in China earlier this year further solidified the company's foothold in the country.

"Elon owes a hell of a lot to the Chinese," Watson acknowledges, citing how the country’s ability to scale manufacturing quickly was instrumental in Tesla’s rise to global prominence. "China has gone from nothing, to important, to critical for Tesla."

This increasing dependence has only deepened over time, as Tesla shifted its battery supply from NCA (Nickel Cobalt Aluminum) batteries to LFP (Lithium Iron Phosphate) batteries, which are primarily manufactured in China.

Even a temporary shutdown due to the Covid-19 pandemic in 2022 resulted in significant losses, with Musk describing the quarter as “tough” and vehicle deliveries dropping by 18 percent. If the Shanghai factory were to face a permanent closure, the long-term damage to Tesla’s production and global sales would be far more devastating.

Tesla’s ties to China go beyond simple business relationships. Musk’s close association with U.S. President Donald Trump has made him a polarizing figure in the eyes of both international governments and consumers. Governments in countries like Canada and Germany have begun to treat Tesla more skeptically, especially in light of Musk’s controversial political interventions.

Tesla’s satellite internet business, Starlink, has already been targeted by Canada, and German Chancellor Friedrich Merz suggested that there could be "consequences" for Tesla’s Berlin gigafactory due to Musk’s political influence.

"Musk needs to hold on to his China business," Russo warns. "He can’t afford to have happen in China what’s happened everywhere else for him." The political climate surrounding Tesla has become increasingly precarious, with growing concerns over Musk’s influence on U.S. politics and his deepening ties to China.

While China has not explicitly threatened to close Tesla’s Shanghai factory, the country’s track record of cracking down on foreign corporations should not be underestimated. The Chinese government has previously punished companies and entrepreneurs that cross it, including Alibaba founder Jack Ma, who faced significant repercussions after criticizing the government.

Despite this, China’s government is unlikely to cut Tesla loose entirely. According to Russo, Chinese officials need Tesla almost as much as Musk needs them. "To be considered open for business, China needs Tesla," Russo says.

Tesla serves as a high-profile example of a successful foreign company thriving in China, and the government is likely to continue supporting Tesla’s operations to maintain the image of a welcoming environment for foreign investment.

Moreover, Musk’s informal influence with the U.S. administration, particularly with Trump, makes him a valuable asset for China. If Beijing were to leverage Musk as a backchannel to influence U.S. policy or de-escalate trade tensions, the Chinese government could use Tesla’s operations as a bargaining chip.

The geopolitical stakes surrounding Tesla’s operations in China are immense. Musk has already been involved in discussions with other world leaders, including Russian President Vladimir Putin, about the war in Ukraine.

It is not implausible to suggest that Chinese officials have already used Musk as an intermediary to negotiate with the U.S. government and ease tensions in the trade war.

Some critics have raised concerns that Musk’s deepening ties to China could make him a potential security risk, with the possibility that he could be beholden to foreign interests. "If Elon were not so critical to U.S. policy, they would have nationalized that company ages ago," says financial analyst Anne Stevenson-Yang.

Elon Musk’s deepening dependence on China has put Tesla in a precarious position. While the Shanghai gigafactory has been instrumental in Tesla’s rise, its closure would send shockwaves through the company’s global operations, potentially resulting in a loss of billions in revenue and a collapse in stock prices.

As tensions between the U.S. and China continue to grow, Musk’s position as the world’s richest man could be in jeopardy, and Tesla’s future could hinge on the whims of the Chinese government. The stakes have never been higher for both Musk and the global EV market.