In a rare moment of convergence between Wall Street insight and Silicon Valley pragmatism, the financial world found itself reeling this week after Tesla CEO Elon Musk responded publicly to billionaire investor Ray Dalio’s dire warnings about America’s diminishing global influence. While Dalio issued an ominous proclamation forecasting the breakdown of U.S. dominance, it was Musk’s blunt concession that delivered the real jolt: China, not the United States, is now the world’s true consumption engine—and no combination of American or European spending power can match it.

The discussion began when Ray Dalio, the founder of Bridgewater Associates and a seasoned voice on global macroeconomics, published a sobering essay titled “It’s Too Late: The Changes Are Coming.” In it, Dalio declared that the post-World War II global order—anchored by U.S. economic might and political leadership—is collapsing.

He pointed to unprecedented trade imbalances, fiscal overextension, and a dramatic shift in global trust away from U.S. institutions. “We are at the end of a long-term debt cycle and empire cycle,” Dalio warned. “There’s no way to keep consuming more than we produce without triggering a reckoning.”

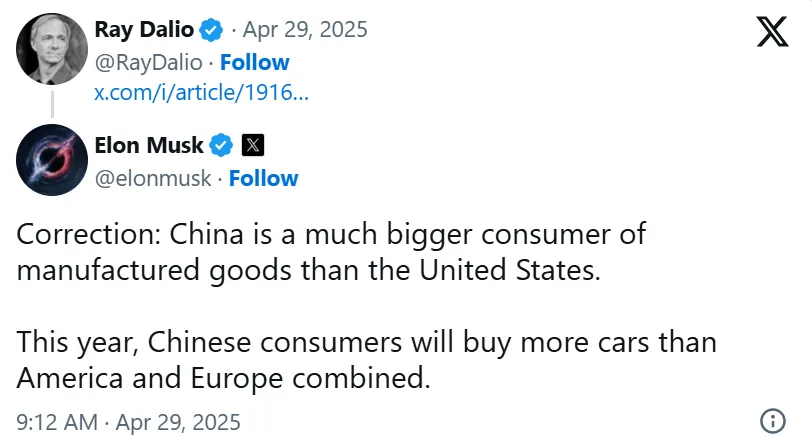

Dalio’s thesis rests on a critical assumption: that the United States remains the heart of global demand, the consumer of last resort. But Elon Musk directly challenged this core idea with a sharply worded response on X, the platform formerly known as Twitter.

“Correction,” Musk wrote. “China is a much bigger consumer of manufactured goods than the United States. This year, Chinese consumers will buy more cars than America and Europe combined.”

For a figure as unapologetically patriotic as Musk—whose ventures have largely been built within and for the U.S. market—this admission is significant. It signals an unflinching recognition that the center of global economic gravity has shifted eastward, and it may never swing back.

While Dalio frames his concern in terms of warnings and potential remedies, Musk’s remark is a declaration of an irreversible new reality: the transition has already happened.

The underlying data backs up Musk’s assertion. China’s household spending is climbing steadily. According to CEIC, annual household expenditure per capita rose to $4,802.36 by December 2024, compared to $4,660.37 a year earlier.

More tellingly, Statista forecasts that Chinese household disposable income per capita will reach $6,510 by 2025. Total consumer spending in the country is projected to hit a staggering $7.73 trillion in the same year, signaling not just growth, but momentum that surpasses the Western economies when combined.

In contrast, the U.S. faces mounting headwinds. National debt levels are at historic highs, monetary policy is constrained by inflationary pressure, and political dysfunction continues to erode domestic and international confidence.

Dalio asserts that assuming the U.S. can continue to borrow endlessly from abroad—while paying back creditors with strong, stable dollars—is “naive.” The world, he argues, is moving toward decoupling, with many countries seeking alternatives to the dollar-based system that has prevailed since Bretton Woods.

Perhaps more alarming than the raw economic data is the philosophical divergence between the two men. Dalio calls for “calm, analytical, and coordinated engineering” to manage America’s decline and prevent collapse.

He believes there is still time to rebalance the system if stakeholders act with urgency and unity. Musk, on the other hand, appears to imply that the tipping point has already passed. His brief but biting commentary leaves little room for reformist optimism. In his view, the world is no longer debating whether China has taken the lead—it is simply adjusting to that fact.

This shift has profound geopolitical implications. If the U.S. is no longer the global consumer base sustaining multinational industries, its leverage in international negotiations—on trade, currency, and defense—will inevitably erode.

Emerging markets, particularly in Asia, will look increasingly to Beijing rather than Washington for economic alignment. The ripple effects could reach into everything from supply chain realignment to the future of sanctions regimes and diplomatic clout.

For American policymakers, the conversation between Dalio and Musk is a wake-up call from two radically different perspectives. One is a calculated alarm from a financier deeply versed in historical cycles; the other is a tech billionaire known for shaping, rather than observing, the future. Yet both are saying the same thing in their own ways: America’s days as the unrivaled global center are numbered.

And while many in the political establishment may still cling to the belief in American exceptionalism, the market is already speaking a different language. Investment flows, trade routes, and consumer trends are drifting toward China, not as a future prospect but as a present condition.

Musk’s automotive empire, which has long depended on Chinese manufacturing and sales, is living proof of this shift. His statement was not just an opinion—it was a reflection of his bottom line.

To be sure, neither Dalio nor Musk believes the U.S. is fated for irrelevance. But the road back to dominance, if it exists, will require painful introspection, strategic sacrifice, and a sweeping reimagining of America’s place in the world.

As Dalio puts it, the goal should be a “beautiful deleveraging” in which unsustainable debts are unwound with minimal chaos. But whether the political will or institutional clarity exists to execute such a transformation remains an open question.

In the meantime, China marches forward. With an expanding middle class, rapidly modernizing infrastructure, and a government willing to pursue long-term industrial policies, the nation is not just catching up—it is redefining the rules.

American and European leaders would do well to heed the words of Elon Musk, a man who rarely praises rivals, but who now openly acknowledges that the East has outpaced the West in one of the most critical arenas of economic power: consumption.

The age of American hegemony is not ending in fire or fanfare—it is slipping away, measured in car sales, household budgets, and GDP growth charts. Musk’s tweet may have been short, but its implications are seismic.

For those still operating under the assumption that the U.S. is the world’s consumer engine, the reality check has arrived. And this time, it comes from the man who helped build the electric future—only to see that future accelerating somewhere else.