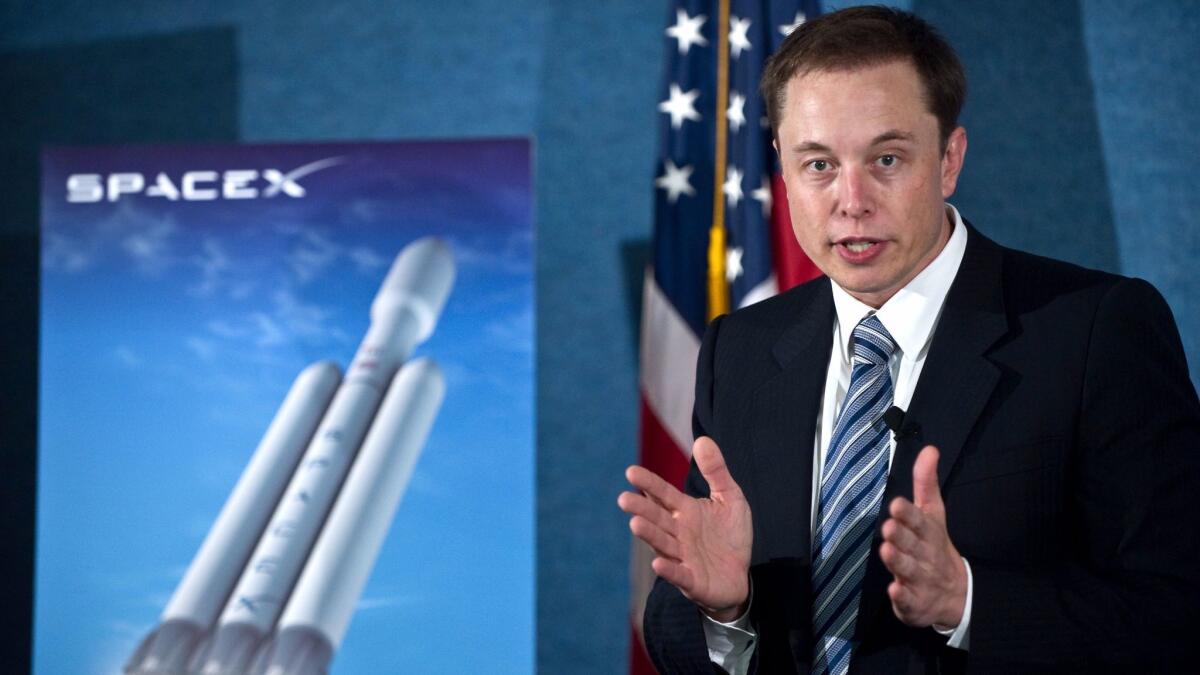

The story of SpaceX’s rise from near bankruptcy to a leading force in space exploration is inseparable from the personal sacrifice and audacious risk-taking of its founder, Elon Musk.

During the company’s darkest hours in the late 2000s, when successive rocket failures threatened to end the dream of privatizing space travel, Musk made the extraordinary decision to invest nearly all of his personal wealth to keep SpaceX alive.

This gamble, driven by unyielding faith in the company’s vision, marked a defining moment in the history of private aerospace and cemented Musk’s reputation as a fearless entrepreneur willing to bet everything on a future few believed possible.

SpaceX was born out of Musk’s frustration with the astronomical costs and limited progress of traditional space agencies. After making his initial fortune from PayPal’s sale, Musk envisioned dramatically lowering the cost of launching payloads into orbit by developing reusable rocket technology and innovating in spacecraft design.

In 2002, he founded Space Exploration Technologies Corp., with the ambitious goal of revolutionizing space travel and eventually colonizing Mars. However, turning this vision into reality proved vastly more difficult and expensive than Musk initially anticipated.

The company’s early years were marked by relentless technical challenges and financial strain. SpaceX’s Falcon 1 rocket was its first attempt to develop a low-cost, liquid-fueled launch vehicle, but initial flights were failures.

The first three launches between 2006 and 2008 failed spectacularly, resulting in the loss of costly hardware, delayed schedules, and waning investor confidence. These setbacks depleted SpaceX’s limited funds and cast doubt on the company’s survival. Elon Musk, who had already invested heavily in Tesla, found himself confronting the real possibility that SpaceX—and much of his personal fortune—would be lost.

As SpaceX edged toward bankruptcy, Musk faced a critical decision point. Conventional wisdom might have advised pulling back or seeking external investors, but Musk chose to double down.

He personally poured tens of millions of dollars into the company, depleting the bulk of his remaining wealth to fund continued rocket development and keep operations going. This level of financial exposure was unprecedented for a CEO in the aerospace industry and revealed a level of personal commitment rarely seen in business.

Musk’s decision was not merely about capital—it was about signaling his belief in SpaceX’s mission and inspiring confidence among employees, partners, and smaller investors. By putting his own money on the line, Musk showed that failure was not an option.

This helped maintain morale within a team facing repeated disappointments and uncertainty. It also demonstrated to stakeholders that Musk was personally invested in the company’s success, creating a powerful narrative that attracted further support.

The breakthrough came with the fourth Falcon 1 launch in September 2008. After three failures, the rocket successfully reached orbit, marking a historic milestone as the first privately developed liquid-fueled rocket to do so.

This achievement validated Musk’s vision and technical approach, restoring confidence in SpaceX’s capabilities. Crucially, it enabled the company to secure a $1.6 billion contract with NASA to develop the Falcon 9 rocket and Dragon spacecraft, providing the financial lifeline and credibility needed to scale operations.

Musk’s financial commitment during this crisis was more than a personal sacrifice—it was a catalyst for a private space industry revolution. Without his willingness to risk his fortune, SpaceX might have folded, and the era of commercial spaceflight could have been delayed indefinitely.

Instead, SpaceX became a pioneer in developing reusable rocket technology, dramatically lowering launch costs and increasing mission frequency. The company’s innovations now drive satellite internet initiatives, cargo deliveries to the International Space Station, and ambitions for crewed missions to Mars.

The risks Musk took were profound. At one point, reports indicated that Musk was close to personal bankruptcy, with his assets drained to sustain SpaceX and Tesla simultaneously. This financial stress took a toll on Musk’s personal life and required extraordinary resilience.

However, Musk’s vision for a multiplanetary future, coupled with a relentless work ethic and belief in technological breakthroughs, kept him focused. His willingness to bear the burden personally stands as a rare testament to entrepreneurial courage.

Beyond financial risk, Musk’s leadership during SpaceX’s early struggles shaped the company’s culture of innovation and tenacity. He demanded high performance, rapid problem-solving, and a readiness to confront failure head-on.

Employees describe a high-pressure environment where deadlines were tight, and innovation was expected to be relentless. Musk’s direct involvement in engineering and management decisions ensured that the company moved swiftly from conceptual ideas to practical applications. This culture was critical in overcoming the enormous challenges of aerospace development.

Musk’s gamble also challenged traditional aerospace paradigms. Historically, space exploration was dominated by government agencies with vast budgets and slow-moving bureaucracies.

Musk’s willingness to take personal financial risks and drive rapid innovation contrasted sharply with these established models. His approach spurred a wave of private space companies and renewed public interest in space exploration, redefining the industry landscape.

Critics have argued that Musk’s financial overextension was reckless and could have jeopardized his other ventures and personal wealth. They caution that such risk-taking, while occasionally fruitful, is unsustainable and may lead to catastrophic failures.

However, Musk’s story demonstrates how visionary leadership and calculated risk can overcome seemingly insurmountable odds. His gamble illustrates the profound interplay between individual vision, financial commitment, and technological innovation that drives transformational breakthroughs.

Today, SpaceX stands as a testament to Musk’s early sacrifices and vision. The company’s advancements in reusable rockets, commercial crew programs, and satellite constellations have reshaped global space capabilities.

Musk’s personal financial risk laid the groundwork for this success, underscoring the critical role that bold entrepreneurship plays in technological progress. SpaceX’s trajectory offers lessons on perseverance, risk management, and the power of personal conviction in the face of adversity.

Moreover, Musk’s near-bankruptcy investment in SpaceX has inspired a new generation of entrepreneurs and innovators. His story is cited widely as an example of how high-risk, high-reward strategies can redefine industries.

The narrative of an entrepreneur risking everything for a visionary dream resonates deeply in Silicon Valley and beyond, encouraging others to pursue ambitious goals despite uncertainty.

In conclusion, Elon Musk’s decision to invest nearly all his personal fortune to rescue SpaceX from financial ruin was a defining moment in modern entrepreneurship and space exploration. This extraordinary act of faith and commitment not only saved a struggling company but ignited a private space revolution that continues to push the boundaries of what humanity can achieve.

Musk’s story exemplifies the fusion of personal sacrifice, visionary leadership, and technological ambition that drives some of the most transformative advances of our time. As SpaceX charts its course toward Mars and beyond, the echoes of Musk’s early risk-taking will remain a foundational chapter in the story of human progress.

-1747970462-q80.webp)

-1747034518-q80.webp)