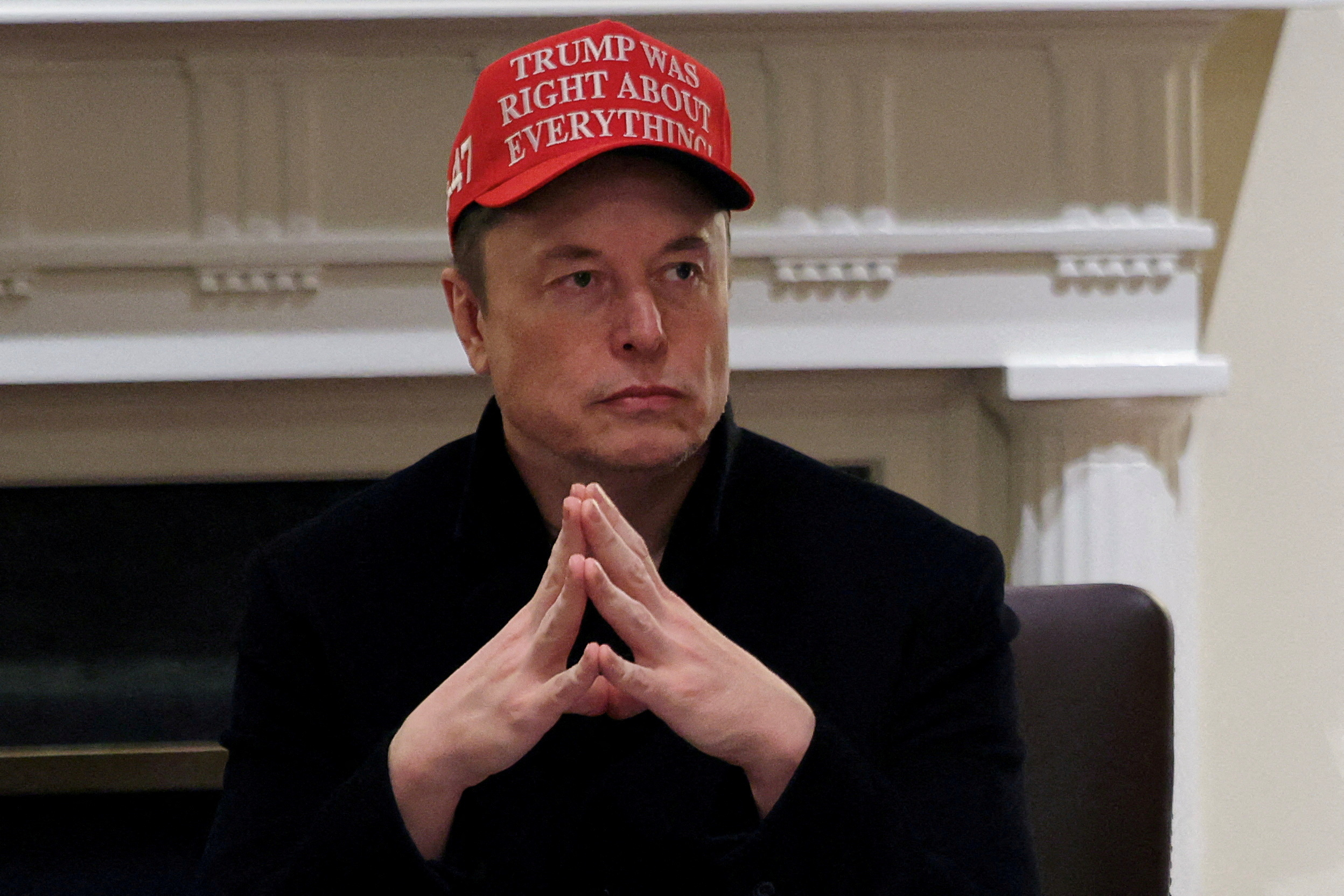

In late 2024, Elon Musk made one of the most controversial decisions of his career by investing $250 million into the U.S. election, backing candidates whose ideologies aligned with his interests. At first glance, this move seemed like a brilliant strategy—Musk's personal wealth skyrocketed by over $100 billion, while his company, Tesla, saw its market capitalization touch a record high of $1 trillion.

However, just a few months later, the ramifications of Musk’s political involvement became starkly apparent, as Tesla’s market value plummeted by a staggering $800 billion. What began as a gamble that paid off in terms of profit quickly turned into a costly setback, one that shook both Musk's business empire and the tech industry as a whole.

Musk’s decision to invest heavily in the U.S. election wasn’t just about endorsing political candidates—it was a calculated business move aimed at securing favorable policies for his companies. By aligning himself with political figures who promised tax cuts and deregulation, Musk hoped to create a more conducive environment for Tesla and his other ventures.

His significant contributions to political campaigns initially seemed to pay off. With the successful election of his preferred candidates, the markets reacted favorably. Tesla’s stock surged, and Musk's fortune soared to previously unseen heights, exceeding $100 billion in gains. The connection between Musk’s political investments and the subsequent financial boost to his companies was evident to many.

However, the early success Musk enjoyed from his political strategy quickly turned sour as the political environment began to shift. Tesla’s stock price, which had once been riding high on the back of favorable political developments, began to face intense pressure. Investors grew increasingly disillusioned as Musk’s involvement in politics became more public, polarizing his fan base and business partners alike.

The focus shifted from Tesla’s technological innovations and market performance to Musk’s political commentary, which some critics viewed as a distraction from his company’s core goals. The result was a significant devaluation of Tesla’s stock, which saw its market capitalization erode by over $800 billion, wiping out a large portion of the gains Musk had made in the previous months.

The loss of Tesla’s market value sent shockwaves throughout the tech industry, and Musk’s decision to wade into politics was quickly reevaluated by many as a misstep. Tesla, once seen as a symbol of innovation and sustainability, was now facing a credibility crisis.

As the company’s stock price plummeted, Musk found himself in a difficult position. His political affiliations, once seen as a potential boon for his business, had alienated a significant portion of investors, employees, and consumers who no longer saw his actions as being in the best interest of Tesla.

In the face of these challenges, Musk began to reconsider his strategy. While his political involvement had initially provided short-term gains, it became clear that the long-term consequences were far more detrimental to his reputation and his companies. Musk, known for his ability to pivot and adapt, shifted his focus back to what had made him successful in the first place: innovation and technological advancement.

He ramped up efforts to push Tesla’s electric vehicle technology further, while also returning his attention to SpaceX, Neuralink, and other groundbreaking projects. The shift marked a turning point in Musk’s leadership, as he recognized that his focus needed to return to the core values of his companies—pioneering new technologies and changing industries.

The fallout from Musk’s political gamble serves as a cautionary tale for business leaders and investors alike. The lesson here is clear: even the most successful entrepreneurs can face significant risks when they step outside their core business practices and get involved in politics. While Musk’s influence in the tech industry is undeniable, his venture into political investment proved that there is a delicate balance between innovation and public perception.

For Musk, the $250 million bet on the election may have delivered some initial rewards, but the long-term damage to Tesla’s market value was a stark reminder of the volatile nature of politics and business.

For Tesla, the road to recovery is now more uncertain than ever. With its market value dramatically reduced, the company must regain the trust of investors and consumers alike. Musk has since focused on pushing the envelope in electric vehicle technology and sustainability efforts, but the shadow of his political involvement still looms large.

It remains to be seen whether Tesla can fully recover from the damage caused by Musk’s political gamble or if this episode will continue to impact the company’s growth trajectory. The lessons from Musk’s $250 million political gamble extend beyond the tech industry.

In the broader business world, this story highlights the importance of maintaining a clear focus on core business operations and avoiding distractions that may alienate key stakeholders. Business leaders must recognize that their personal actions and public statements can have far-reaching consequences for their companies. Musk’s experience serves as a reminder that even the most influential figures in business must tread carefully when engaging in political matters, as the fallout can have lasting effects on their companies and their legacy.

In conclusion, Elon Musk’s foray into political investment, which initially seemed like a brilliant strategy for business growth, turned into a costly miscalculation. While he gained over $100 billion in personal wealth and saw Tesla’s market capitalization rise temporarily, the fallout from his political involvement led to a dramatic $800 billion loss in Tesla’s market value. This saga underscores the unpredictable nature of politics and business, reminding business leaders and investors of the risks involved in stepping into the political arena.

Musk’s story highlights the fine line between innovation and controversy, and the importance of maintaining a strategic focus on what truly drives success in business. As the dust settles, the question remains: can Musk recover from this political gamble, or will it continue to haunt his legacy as one of the world’s most influential entrepreneurs?

-1747391257-q80.webp)