California Senator Adam Schiff is facing mounting legal trouble after being referred to the Department of Justice for possible prosecution in an alleged mortgage fraud scheme that could result in substantial fines, restitution, or other penalties, according to financial crime experts.

The allegations stem from Schiff’s reported designation of two different properties—one in California and one in Maryland—as his “primary residence” during the same period.

Experts say this dual-claim tactic may have allowed the longtime lawmaker to secure financial benefits from lenders and local tax authorities, potentially defrauding both institutions and taxpayers over the course of several years.

According to The Washington Times, Schiff and his wife claimed their home in Potomac, Maryland, as their primary residence from 2013 to 2019, which significantly reduced their mortgage payments.

This designation likely lowered the interest rate on their loan, as primary residences are typically viewed by lenders as lower-risk assets compared to second homes or investment properties.

At the same time, Schiff reportedly continued to claim a property in Burbank, California, as his primary residence—an assertion that allowed him to secure a $7,000 tax exemption from the state of California.

By claiming both residences as “primary,” Schiff may have violated mortgage and tax laws, which generally require that borrowers designate only one property as their main home.

As a U.S. Senator representing California—and previously a longtime member of the House from the state—Schiff is legally required to maintain his primary residence in California to fulfill residency requirements for elected office.

This dual-claim arrangement raises questions about whether Schiff knowingly misled lenders and tax authorities in order to receive financial perks not available to the average homeowner.

Schiff has denied any wrongdoing, insisting that both his lenders were aware of his bicoastal lifestyle and did not consider either home to be a vacation property.

However, critics argue that his explanation fails to address the legal definition of a “primary residence,” which typically hinges on where an individual spends the majority of their time, receives mail, votes, and claims tax benefits.

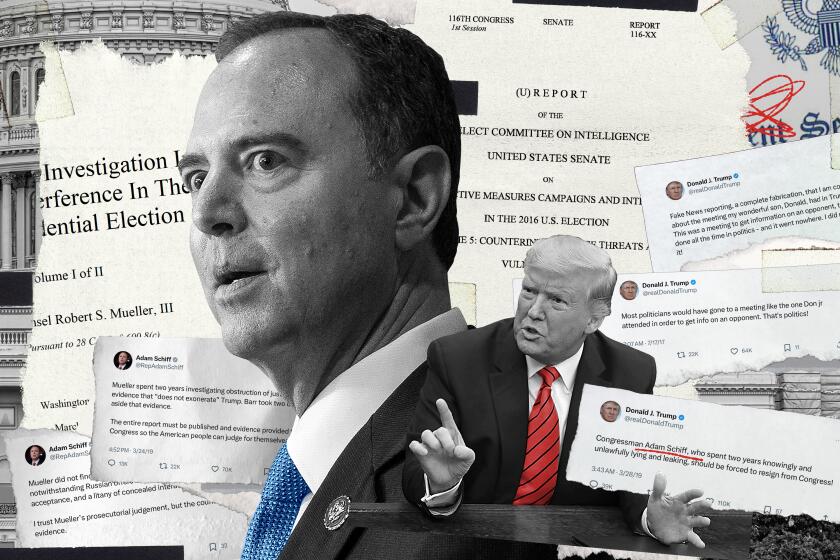

The timing of the allegations adds a layer of irony for Schiff, who rose to national prominence as one of the most aggressive critics of former President Donald Trump’s business dealings.

Schiff repeatedly called for Trump’s prosecution on allegations of fraud, even after many of those charges were dismissed by legal experts as politically motivated.

Now, with Schiff himself in the DOJ’s crosshairs, Trump and his allies are accusing the California Senator of hypocrisy.

In a fiery Truth Social post this week, Trump labeled Schiff a “scam artist,” accusing him of securing favorable mortgage terms in 2009 by fraudulently declaring his Maryland property as a second home, only to later designate it as a primary residence.

Trump further claimed that Fannie Mae’s Financial Crimes Division had uncovered the misconduct.

“Mortgage fraud is very serious, and CROOKED Adam Schiff (now a Senator) needs to be brought to justice,” Trump wrote. “I have always suspected Shifty Adam Schiff was a scam artist.”

Keith Gross, a Florida-based defense attorney specializing in financial crime, told The Times that mortgage fraud cases of this nature are generally clear-cut and rarely proceed to trial.

“These cases tend to be document-based and rely heavily on signed declarations and public records,” Gross said.

“If the answers to those questions are undisputed—such as whether Schiff personally signed the loan documents or claimed the Maryland house as his full-time home—there may not be much to argue about in court.”

Gross said that if the evidence supports the claims, Schiff could be facing a plea deal that includes financial penalties, restitution for the fraudulently claimed benefits, and possibly additional sanctions.

Jail time, while unlikely for first-time offenders in mortgage fraud cases, is not completely off the table depending on the scale of the alleged deception.

“This type of fraud is taken seriously, especially when committed by public officials,” Gross added. “Even if it doesn't result in prison time, the public embarrassment and loss of political capital could be just as damaging.”

The mortgage fraud probe marks a stunning reversal for Schiff, who only recently ascended to the Senate after a long tenure in the House.

Schiff became a household name during the Trump years for his role in leading impeachment efforts and publicly championing the now-discredited Steele dossier, which attempted to link Trump to Russian operatives.

Now, Schiff’s critics are highlighting the irony of his predicament. In 2023, Schiff said of Trump’s legal issues:

“He’s accused me of treason, leaking classified info, and fraud. All baseless, all without merit. But his attacks on the rule of law are more dangerous than ever.”

Those words may now come back to haunt him as investigators comb through years of financial and property records in both Maryland and California to determine the extent of the senator’s alleged misconduct.

The scandal is also providing fresh ammunition for those pushing ethics reform in Washington.

Lawmakers from both parties have increasingly faced scrutiny for using public office to enrich themselves or obtain special treatment, and Schiff’s case could become a flashpoint in the broader push for transparency and accountability.

According to The Times, the new documents released by the Trump administration include communications from Leonard Benardo—an official at a Soros-aligned organization that supported Hillary Clinton’s 2016 campaign.

These communications reportedly offer more context about efforts within the intelligence community to damage Trump’s reputation.

Schiff has long denied any coordination between Clinton allies and his efforts to investigate Trump, but some political observers say the mounting evidence and now his personal legal troubles may diminish his credibility moving forward.

Even Democratic allies are reportedly distancing themselves from the scandal. One anonymous Senate aide told reporters, “If there’s truth to these claims, it’s not a good look.

You can’t be the moral voice of the party while playing games with your mortgage documents.”

As the Department of Justice continues to review the allegations against Senator Adam Schiff, the fallout from the mortgage fraud probe could have lasting implications for his political career and legacy.

Whether or not he is ultimately charged, the damage to his public image may be irreversible.

If convicted or forced to accept a plea deal, Schiff could face financial penalties, reputational ruin, and the end of a long political journey once defined by moral certainty and now stained by allegations of financial deceit.

And for Trump supporters and critics alike, the case serves as a sobering reminder that in Washington, the fall from moral high ground can be swift—and unforgiving.