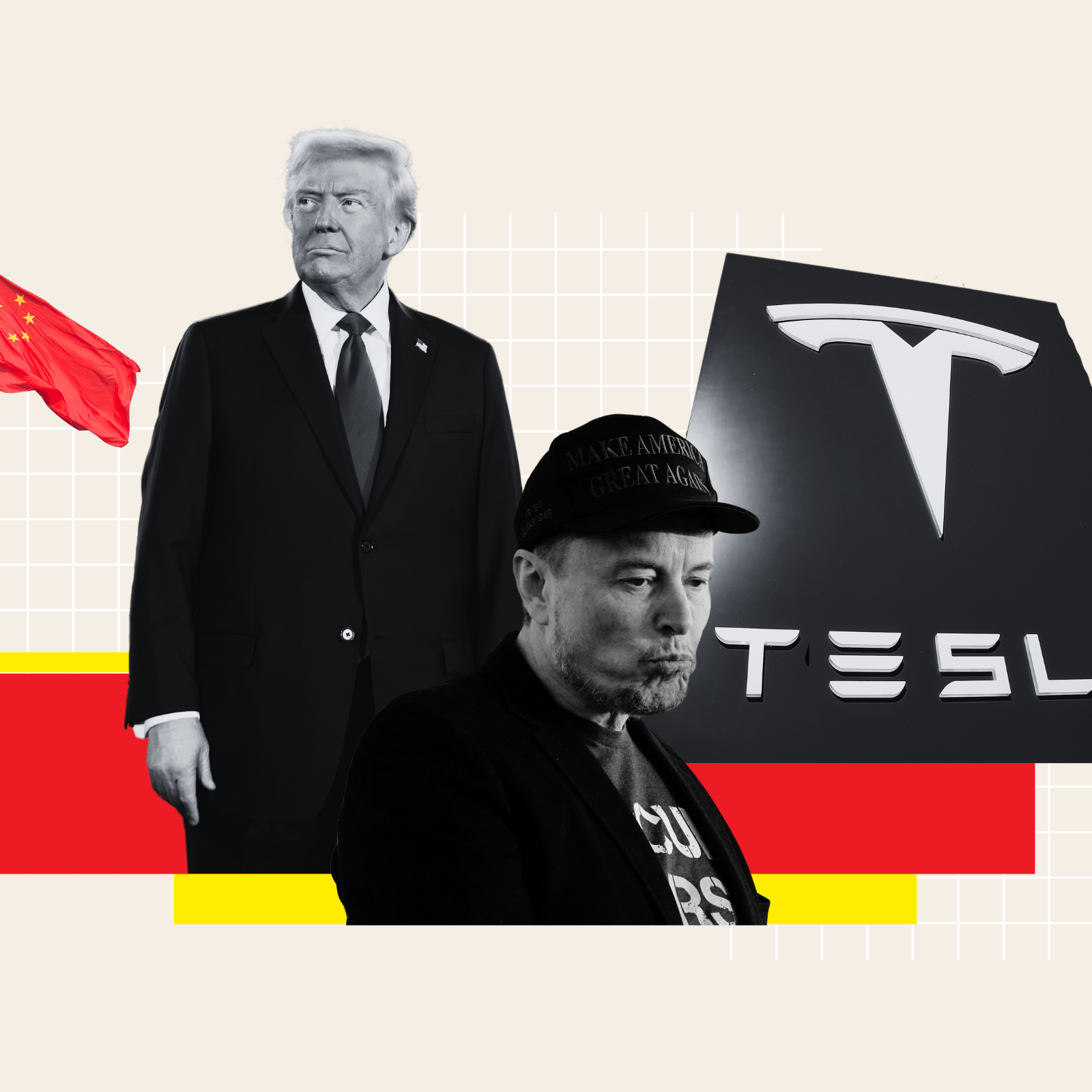

Tesla has suffered a monumental blow to its market value following a public feud between CEO Elon Musk and former President Donald Trump. On Thursday, Tesla’s stock dropped by 14%, leading to a loss of $152 billion in market capitalization.

This drop represents the largest single-day loss in the company’s history, bringing Tesla’s market cap below the $1 trillion mark, with shares closing at $916 billion. This sharp decline comes on the back of a war of words between Musk and Trump over a key spending bill that could have far-reaching implications for Tesla’s future.

The public conflict began when Trump threatened to pull government contracts from Musk’s companies, accusing him of overstepping his bounds and failing to deliver on promises related to electric vehicle (EV) incentives.

Musk, in turn, unleashed a series of angry posts on social media, attacking both the bill and the administration’s handling of EV-related policies. His comments, combined with the threat of losing government contracts, have raised concerns among investors, causing Tesla’s stock to experience one of its most significant declines to date.

The root of the conflict lies in the proposed spending bill, which includes measures that would cut incentives for electric vehicles and impose a new annual fee on EV drivers. These provisions have angered Musk, whose companies, including Tesla, heavily rely on government subsidies for the electric vehicle market.

Musk has publicly denounced the bill, calling it a “disgusting abomination,” and has even threatened to push for primary challenges against lawmakers who vote in favor of the legislation. His anger was further fueled by the removal of electric vehicle credits from the bill, which Musk viewed as a direct threat to Tesla’s business.

In response to Musk’s criticism, Trump took to Truth Social, where he wrote, “Elon was ‘wearing thin,’ I asked him to leave, I took away his EV Mandate that forced everyone to buy electric cars that nobody else wanted (that he knew for months I was going to do!), and he just went CRAZY!”

This remark was a sharp departure from the once-close relationship between the two men, which had been built on mutual interests in technology, deregulation, and economic growth. Trump’s statement, combined with his threats to end government contracts with Musk’s companies, sent shockwaves through the business and political world.

Trump’s comments, made during a press conference in the Oval Office, further escalated the situation. He said, “Elon and I had a great relationship. I don’t know if we will anymore.

I was surprised.” Musk, known for his direct and often controversial responses, did not hesitate to fire back on social media. “Without me, Trump would have lost the election, Dems would control the House and the Republicans would be 51-49 in the Senate,” Musk posted on X. This pointed remark was a clear indication of Musk’s growing frustration with Trump and a sign that their once-friendly relationship had become irreparably strained.

The public spat between Musk and Trump has not only made waves in the political world but has also had significant financial implications for Tesla. In the days following the feud, Tesla’s stock continued its downward trajectory, losing nearly 18% in a single week.

This brings the company’s share price down by almost 30% year-to-date, further intensifying concerns about Tesla’s ability to maintain its market-leading position in the electric vehicle industry.

The drop in stock price comes despite Tesla’s impressive performance in May 2025, when the company saw a 22% rally, driven by strong demand for its vehicles and a growing market share in key regions.

Musk’s public criticism of the bill and his continued attacks on the Trump administration have created significant uncertainty among Tesla’s investors. The company’s reliance on government incentives for electric vehicles has always been a key part of its business strategy, and the potential loss of these incentives could have long-term consequences for Tesla’s financial outlook.

As one of the largest players in the electric vehicle market, Tesla’s future growth is closely tied to the success of government policies that promote clean energy and sustainable transportation. The proposed cuts to EV credits and the introduction of new fees for EV drivers have made investors nervous, causing a ripple effect across the stock market.

Adding fuel to the fire, Musk’s criticism of the administration has also led to internal tension at Tesla. Employees and executives within the company have been forced to navigate the fallout from Musk’s actions, with some voicing concerns about the impact of his public political battles on Tesla’s reputation.

In one instance, a Tesla employee was reportedly fired after creating a website to protest Musk’s political involvement, which some workers believed was hurting the company’s brand.

The internal unrest is compounded by the ongoing financial turmoil, which has raised questions about Musk’s ability to effectively lead Tesla through this period of uncertainty.

Despite the turmoil, Musk remains committed to his long-term vision for Tesla and SpaceX. He has continued to push forward with ambitious projects, such as the development of Starship, the next-generation rocket designed for interplanetary travel, and the expansion of Starlink, his global satellite internet service.

Musk has made it clear that his focus is on pushing the boundaries of technology and advancing his goals for space exploration and sustainable energy. However, his political activities and the public fallout from his feud with Trump have made it increasingly difficult for Musk to focus solely on these initiatives.

As the situation unfolds, it remains to be seen how Tesla and Musk will recover from the damage caused by this public feud. The company’s market capitalization has been significantly impacted, and the political tensions between Musk and Trump show no signs of abating.

While Musk continues to be one of the most influential figures in the tech and business world, his involvement in political battles may have lasting consequences for his reputation and the future of Tesla.

Investors, employees, and industry observers will be closely watching to see how this conflict evolves and what impact it will have on Musk’s companies in the long term.

In conclusion, the public feud between Elon Musk and Donald Trump has escalated into a full-blown crisis, with significant financial repercussions for Tesla. The dispute over a key spending bill, combined with personal attacks and threats to end government contracts, has led to a sharp decline in Tesla’s stock price, resulting in a $152 billion loss in market value.

Musk’s political involvement and his ongoing conflict with Trump have created uncertainty within the company and the market, raising questions about Tesla’s future.

As this saga unfolds, the outcome of the Musk-Trump feud will have far-reaching implications for both men and the companies they lead.The stakes are high, and the resolution of this conflict will shape the future of both the electric vehicle industry and the broader tech and political landscape.

-1749890798-q80.webp)