In a sweeping new initiative announced this week, President Donald Trump has ordered a nationwide audit aimed at preventing illegal immigrants from accessing taxpayer-funded public benefits.

The audit marks one of the most aggressive efforts in recent years to ensure that social programs designed for American citizens and legal residents are not being exploited by those who entered or remain in the country unlawfully.

The Scope of the Audit

According to reports from the administration, Trump’s directive targets at least twenty-eight federal programs spanning multiple agencies, including the Department of Housing and Urban Development (HUD) and the Department of Health and Human Services (HHS).

These programs include vital assistance avenues such as Medicaid, Head Start, food stamps, and the Section 8 Housing Choice Voucher Program, which provides rent subsidies for low-income families.

HUD Secretary Scott Turner, who is overseeing the housing portion of the audit, has instructed all public housing authorities to verify the citizenship or immigration status of Section 8 recipients within thirty days of receiving official notice. Turner emphasized that this process is necessary to maintain integrity and transparency in how public funds are allocated.

“Every dollar that goes to someone here illegally is a dollar taken from an American family in need,” Turner stated in a press briefing. “This audit is about fairness, accountability, and the rule of law.”

The Reason Behind the Push

The audit comes amid growing public concern over reports that millions of dollars may have been improperly distributed to individuals who are not legally eligible for government assistance.

Although federal law has long prohibited illegal immigrants from receiving Section 8 housing or similar benefits, enforcement mechanisms have often been inconsistent or poorly tracked.

![]()

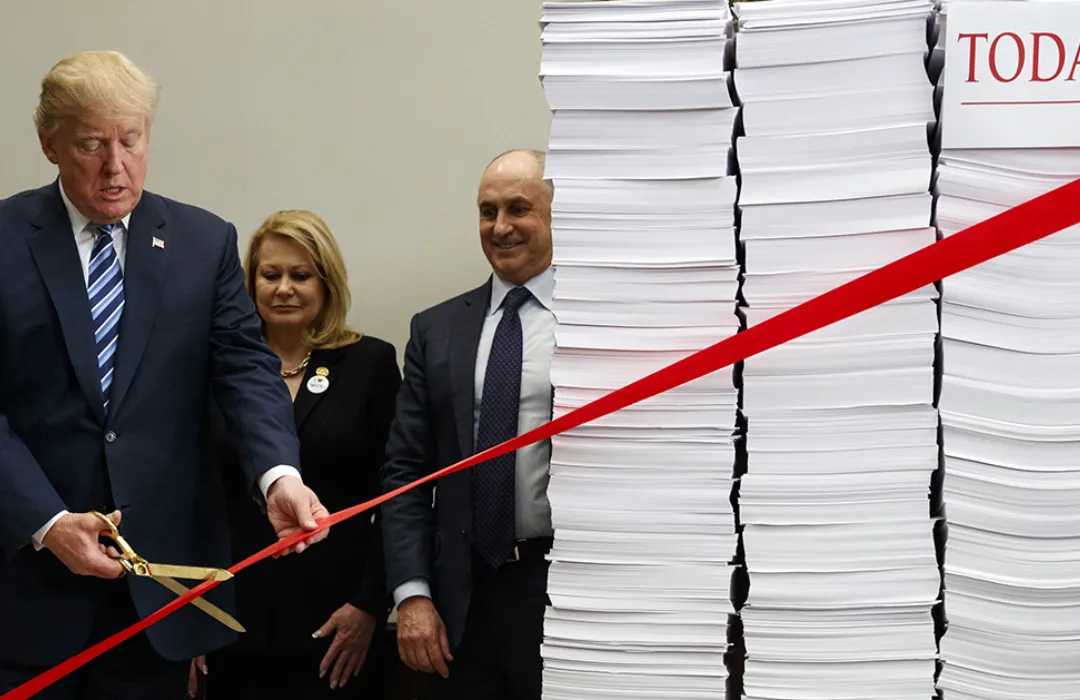

President Trump underscored his motivation in a recent statement: “The only way to catch them and stop this insanity is to conduct an audit and kick out the offenders. Taxpayers work hard, and their money should help Americans — not those who broke our laws to get here.”

The move reflects his broader political philosophy of prioritizing American citizens and restoring what he calls “equal treatment under the law.” By focusing on verification and compliance, the audit seeks to reassure the public that government programs are not being abused.

Legal and Political Implications

While supporters hail the initiative as long overdue, critics argue that it risks stigmatizing immigrant communities and creating unnecessary bureaucratic hurdles for legitimate recipients.

Opponents also note that past audits have sometimes resulted in eligible families temporarily losing benefits due to documentation delays or administrative errors.

Despite such criticism, legal experts say the government is well within its authority to review compliance with existing laws. Federal regulations dating back to 1980 clearly establish that only U.S. citizens and certain legal residents may receive federally funded housing or welfare benefits. Trump’s audit, they note, does not introduce new restrictions but enforces ones already on the books.

“This isn’t about creating new policy — it’s about applying the law fairly and uniformly,” said constitutional attorney Robert Whitman. “If the audit exposes weaknesses in the system, fixing those gaps will help everyone.”

The Human and Economic Context

The issue of illegal immigrants receiving benefits has been a longstanding flashpoint in American politics. Proponents of tighter enforcement argue that allowing such access encourages more illegal immigration and strains limited resources intended for vulnerable citizens.

According to recent studies cited by Trump’s team, even a small percentage of fraudulent claims can cost taxpayers billions over time. The audit aims to quantify the extent of misuse and reclaim funds where possible.

Critics, however, contend that the problem is exaggerated. They argue that most undocumented immigrants are excluded from federal benefits already and that scapegoating them distracts from broader systemic inefficiencies.

Yet, for many working-class Americans struggling to pay rent or feed their families, the idea that anyone might receive undeserved aid sparks outrage. The Trump administration is tapping into that sentiment by framing the audit as an act of justice — not discrimination.

Inside the Audit Process

The audit’s design calls for collaboration between multiple federal departments, state agencies, and local authorities. Each participating entity will conduct internal reviews of applicant documentation, Social Security verifications, and immigration records.

Public housing agencies are expected to cross-reference beneficiary lists with federal immigration databases. HHS will use similar data-matching procedures to ensure Medicaid and food assistance recipients meet lawful status requirements.

For families who cannot immediately provide proof of citizenship or legal residency, the directive allows a temporary grace period to submit documentation. However, any benefits distributed during that window may later be subject to repayment or termination if eligibility is not confirmed.

“This is not about punishment; it’s about verification,” Turner clarified. “If you are here legally, you have nothing to worry about. But if you’re taking benefits illegally, those days are over.”

Public Reaction and Political Response

The announcement has ignited fierce debate across the country. Conservative groups and taxpayer watchdog organizations have praised the decision as a long-awaited measure to curb waste and restore confidence in federal programs.

“Finally, someone is standing up for American taxpayers,” said Linda Walsh, a representative from Citizens for Accountability. “We’ve needed a serious audit for years. It’s outrageous that this hasn’t been done sooner.”

Democratic lawmakers, on the other hand, have questioned both the timing and intent behind the initiative. Some view it as a politically charged maneuver designed to energize Trump’s base ahead of election season.

They argue that the administration should focus on expanding access for legal low-income families rather than auditing those already struggling to survive.

“Instead of helping people, they’re trying to scare them,” said Representative Maria Torres of California. “We need reforms that simplify access, not audits that create fear.”

The Historical Context

Federal laws restricting benefits for illegal immigrants date back over four decades. The Immigration Reform and Control Act of 1986 and the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 both reaffirmed that undocumented immigrants are ineligible for most public aid programs.

Nevertheless, enforcement has often been inconsistent due to bureaucratic overlaps and limited verification technology. Advocates of Trump’s audit argue that modern data systems now make it possible to enforce these laws effectively.

“This is the first time we’ve had the tools to truly track where the money goes,” Turner explained. “Technology gives us the power to ensure that every dollar is spent according to the law.”

Potential Consequences

If the audit reveals widespread misuse, the political and fiscal consequences could be significant. Programs found to have distributed benefits unlawfully may face restructuring, and agencies could be required to implement stricter screening procedures.

For eligible American families, the audit could mean faster access to benefits and reduced competition for limited resources. For illegal immigrants caught receiving aid, it could lead to repayment demands, disqualification from future assistance, and even deportation referrals in extreme cases.

Economists predict that the audit could also improve budget efficiency by identifying duplicate or fraudulent claims beyond immigration-related misuse. “This kind of audit doesn’t just stop illegal access — it helps clean up waste across the system,” noted fiscal analyst Jonathan Pierce.

The Broader Message

Beyond its immediate policy impact, the audit symbolizes a broader ideological message from Trump’s movement: that the government must prioritize citizens first. It plays into the “America First” narrative that propelled his earlier campaigns and continues to resonate strongly with his supporters.

For many Americans, the issue transcends immigration itself — it reflects frustration with what they see as a broken system that rewards dishonesty and punishes hard work. By focusing on fairness and legality, the administration hopes to rekindle public trust in how benefits are distributed.

Trump’s statement encapsulated this sentiment: “When Americans see that their taxes are used responsibly, faith in government is restored. We’re not targeting people — we’re protecting citizens.”

Looking Ahead

As the audit proceeds, the findings will likely shape future policy discussions about immigration and welfare reform. If the data confirm significant misuse, it could lead to new bipartisan conversations about updating verification systems and tightening eligibility standards.

Even opponents acknowledge that transparency is essential. “If the audit is done fairly and without political bias, it could provide valuable insights,” said policy expert Elena Ruiz. “The danger lies in using it to demonize communities rather than improve accountability.”

Conclusion

The Trump administration’s audit represents a bold attempt to reassert control over how public benefits are distributed in the United States. Whether seen as a necessary correction or a controversial overreach, the initiative touches on a core national debate about fairness, legality, and the responsibility of government toward its citizens.

By examining every corner of federal assistance — from housing to healthcare to food programs — this audit seeks to transform speculation into evidence, and emotion into policy.

As the process unfolds, Americans on both sides of the political divide will be watching closely to see whether it delivers what it promises: accountability, integrity, and a renewed commitment to the rule of law.