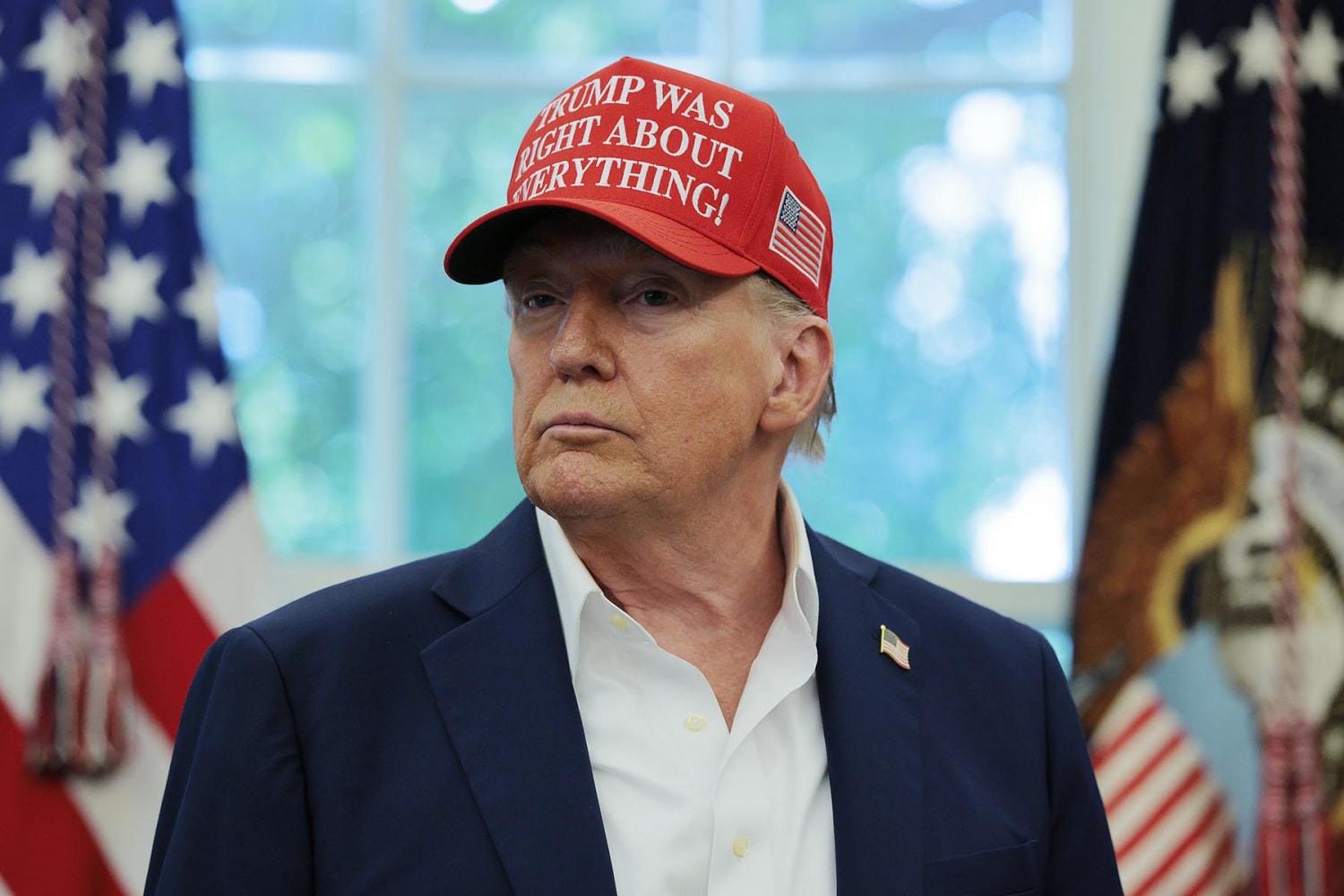

President Donald Trump has made history by removing Federal Reserve Governor Lisa Cook from her position, citing allegations of fraud and deceit that have prompted a Department of Justice investigation.

This unprecedented action marks the first time a sitting Federal Reserve governor has been removed by a U.S. president, highlighting the ongoing tension between the executive branch and the central bank as well as raising questions about the legal boundaries of presidential authority over the Federal Reserve.

Cook, who was appointed to the Federal Reserve by President Joe Biden in 2022 and confirmed by the Senate in September 2023 with a narrow 51-47 vote along party lines, now finds her 14-year term, set to run from 2024 to 2038, cut short due to allegations that she misrepresented her primary residences on mortgage documents.

According to Trump, these actions demonstrate both deceit and gross negligence in financial matters, casting serious doubt on her suitability to oversee one of the most important financial institutions in the country.

In a letter to Cook, Trump cited the Federal Reserve Act as giving him discretionary power to remove a governor for cause. He referred to a criminal referral dated August 15, 2025, submitted by William J. Pulte, the Director of the Federal Housing Finance Agency, to Attorney General Pamela Bondi.

Pulte’s referral alleges that Cook may have made false statements on mortgage documents by declaring two different properties in separate states as her primary residence within a short period.

Trump emphasized the seriousness of the allegations, noting that Cook signed a document for a property in Michigan attesting it would be her primary residence for the upcoming year.

Two weeks later, she allegedly signed another document for a property in Georgia, also stating that it would serve as her primary residence for the same period.

Trump stated that it was inconceivable that Cook was unaware of her first commitment when making the second, implying deliberate intent to misrepresent her residency.

According to the president, the Federal Reserve has a tremendous responsibility in setting interest rates and regulating the nation’s banks. He underscored that Americans must have full confidence in the integrity and honesty of those overseeing monetary policy and financial regulation.

“In light of your deceitful and potentially criminal conduct in a financial matter, they cannot, and I do not have such confidence in your integrity,” Trump wrote. He added that at the very least, Cook’s conduct reflected gross negligence in financial transactions, undermining her competence and trustworthiness as a financial regulator.

Cook has not been charged with any crime, but the allegations have prompted widespread scrutiny. FOX Business reached out to the Federal Reserve for comment, but no statement was immediately provided.

The DOJ is reportedly investigating the mortgage fraud claims, which were brought to federal attention by Pulte, a known ally of Trump who has been a vocal critic of the Federal Reserve’s policies and structure.

The referral alleges that Cook may have falsified bank documents and property records to acquire more favorable loan terms, potentially constituting mortgage fraud under federal criminal statutes.

Trump had publicly threatened to remove Cook from her role just days prior to the action. On Friday, he told reporters, “I’ll fire her if she doesn’t resign. What she did was bad.”

This statement foreshadowed Monday’s historic removal, and it signals the administration’s growing impatience with federal officials who, in Trump’s view, fail to uphold standards of honesty and accountability.

Historically, federal law governing the Federal Reserve system allows a president to remove a sitting governor only for cause. This standard has generally been interpreted as misconduct, malfeasance, or illegal activity rather than disagreements over monetary policy.

Trump’s decision to remove Cook thus introduces the possibility of legal challenges, as it tests the boundaries of presidential authority in overseeing Federal Reserve governors.

Legal analysts have noted that Cook could potentially contest the removal in court, citing the protections afforded to Federal Reserve officials under the Federal Reserve Act.

The context surrounding Cook’s removal also intersects with broader economic concerns. Trump and his allies have consistently called on the Federal Reserve to cut interest rates to stimulate economic growth and reduce the cost of servicing the more than $37 trillion U.S. national debt.

While Trump has previously threatened to remove Fed Chair Jerome Powell over policy disagreements, he has refrained from doing so, highlighting that the Cook removal is rooted in allegations of misconduct rather than policy disputes.

Nevertheless, the unprecedented move could create tension between the executive branch and the central bank, raising questions about the independence of the Federal Reserve.

Cook’s tenure as a Federal Reserve governor had begun amid partisan controversy. Appointed by Biden, she was confirmed on a party-line vote and had become one of the most closely watched figures in the central bank due to her expertise in financial policy and economic research.

She was widely regarded as a competent regulator, with particular emphasis on her knowledge of mortgage lending practices and bank supervision. Her removal, therefore, represents a significant disruption within the Federal Reserve and could impact confidence in the institution’s regulatory capabilities.

The criminal referral that sparked the investigation into Cook’s mortgage filings was filed by William Pulte, whose ties to Trump and interest in financial oversight have drawn attention.

Pulte has been critical of the Federal Reserve in the past, advocating for policies aimed at reducing interest rates and expanding credit availability. By submitting the referral to the DOJ, Pulte triggered an official review into Cook’s mortgage filings and her possible violations of federal law.

The referral claims that by misrepresenting her primary residences, Cook could have sought more favorable loan terms than she otherwise would have qualified for, thereby committing a form of mortgage fraud.

In response to the allegations, the president emphasized the need for accountability at the Federal Reserve. He stated that the American public must be able to trust that those entrusted with regulating the nation’s banks and setting interest rates act with the highest integrity.

Trump framed Cook’s alleged actions as undermining public confidence in the central bank and asserted that her removal was necessary to restore credibility to the institution.

The potential fallout from Cook’s removal extends beyond the individual case. Legal experts suggest that a challenge to her dismissal could result in a landmark court ruling defining the limits of presidential authority over Federal Reserve governors.

Such a ruling could establish precedents that impact the independence of the Federal Reserve, future appointments, and the ability of presidents to intervene in the governance of central bank officials.

Despite the controversy, Trump’s administration has presented Cook’s removal as consistent with its broader agenda of accountability and transparency in financial oversight.

By taking decisive action against a high-ranking official alleged to have engaged in fraudulent activity, the president seeks to reinforce the importance of ethical conduct among federal regulators.

Supporters of Trump have praised the move as a necessary step to protect the integrity of the nation’s financial system and ensure that top officials meet the highest ethical standards.

In the immediate term, the Federal Reserve will need to adjust to the absence of Cook, who had been actively involved in setting policy and overseeing bank regulation.

Her removal could temporarily slow decision-making processes or impact ongoing initiatives. Additionally, her departure may prompt questions about the qualifications and integrity of future appointees, as well as the procedures for evaluating potential conflicts or misconduct among senior officials.

While the DOJ investigation proceeds, Cook’s removal underscores the unprecedented nature of Trump’s actions. No previous president has removed a sitting Federal Reserve governor, making this a historic moment with potentially far-reaching consequences for the governance of the central bank.

As legal experts, policymakers, and financial analysts examine the implications, the case highlights the tension between executive authority and institutional independence, as well as the need for clear standards for accountability within critical government agencies.

In summary, President Donald Trump’s removal of Federal Reserve Governor Lisa Cook over allegations of mortgage fraud represents a first in U.S. history. Cook’s alleged misrepresentations regarding her primary residences prompted the president to exercise his discretionary authority under the Federal Reserve Act, citing a loss of confidence in her integrity and competence.

The move has sparked widespread discussion about the independence of the Federal Reserve, the limits of presidential authority, and the ethical responsibilities of top federal officials.

With the DOJ investigating the allegations and potential legal challenges looming, the outcome of Cook’s removal will likely shape the relationship between the executive branch and the Federal Reserve for years to come.