Rep. Tim Burchett of Tennessee, a key Republican voice in Congress, made it clear on Monday that he remains deeply concerned about the long-term fiscal health of the United States.

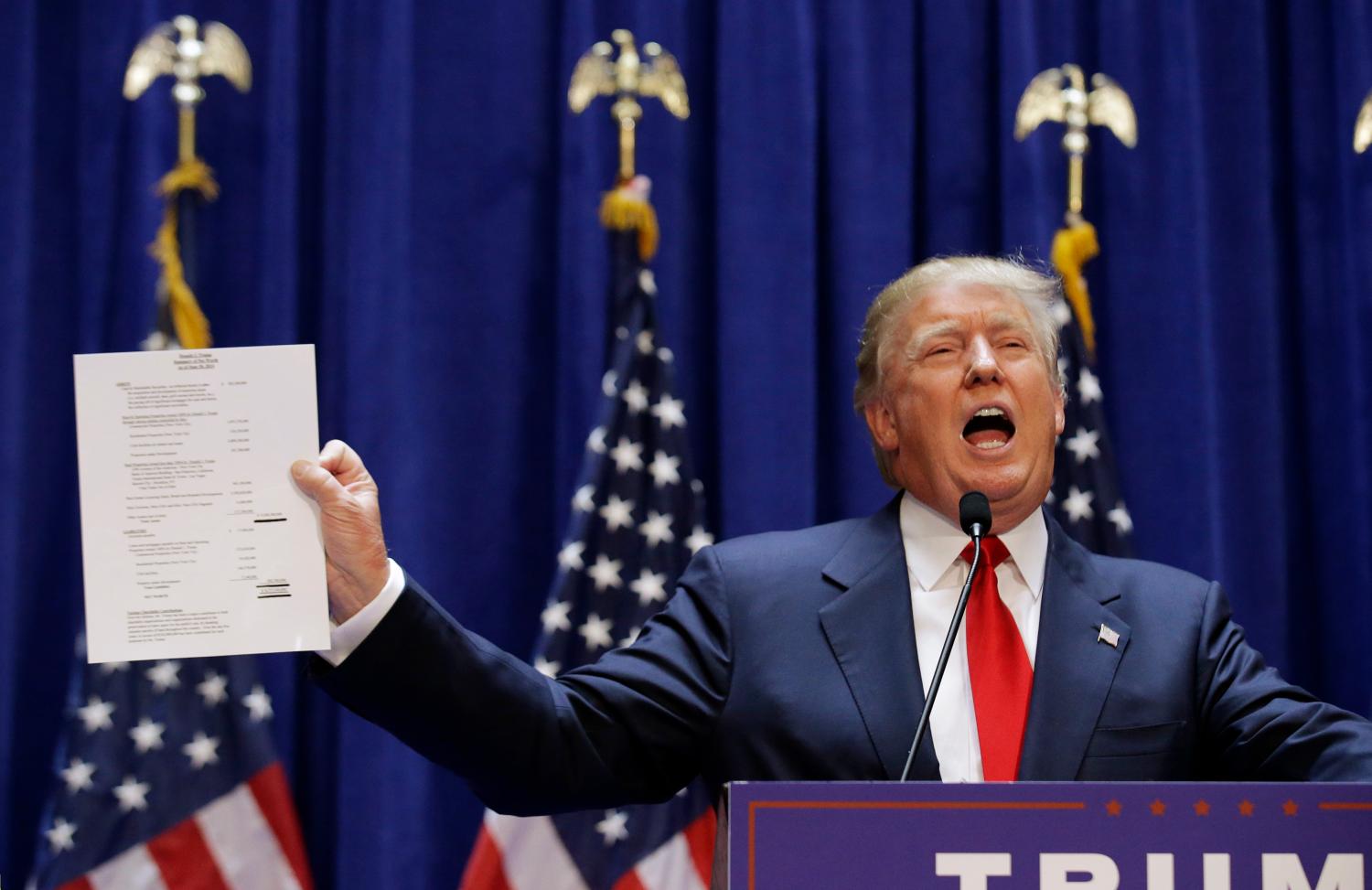

In an interview on NewsNation’s “The Hill,” Burchett indicated that he may oppose President Donald Trump’s tax agenda if it means increasing the nation’s deficit.

While acknowledging that he reluctantly voted for the House version of the bill last month, Burchett expressed skepticism about the potential for more deficit spending as the legislation moves forward in the Senate.

His comments underscore an ongoing debate within the Republican Party regarding the balance between tax cuts, government spending, and the future of America’s fiscal policy.

The tax agenda in question, which is part of Trump’s “big, beautiful bill,” has been eagerly awaited, with the Senate Finance Committee unveiling their version on Monday.

The bill includes a range of provisions aimed at making the 2017 corporate tax cuts permanent, cutting hundreds of billions of dollars in Medicaid spending, and phasing out renewable-energy tax credits that were enacted under President Joe Biden.

While the Senate version of the bill offers several key changes to the House-passed version, one of the most significant aspects is the proposal to raise the debt ceiling by $5 trillion instead of the $4 trillion increase adopted by House Republicans.

Rep. Burchett’s comments reveal a central issue that is dividing Republicans as they debate the future of the Trump tax agenda. In his interview, Burchett expressed concern about the growing deficit, stating, “If it’s more deficit spending, then probably not. I think we need to really take that serious.”

His remarks reflect a broader Republican concern about the sustainability of the nation’s debt and the potential long-term consequences of increasing federal spending.

The debate about deficit spending is not new, but it has become increasingly urgent as the federal government grapples with rising national debt.

The Trump administration’s tax policies, particularly the significant corporate tax cuts enacted in 2017, have contributed to the growing budget deficit, with critics arguing that these cuts have disproportionately benefited the wealthy and corporations while leaving the middle class and working Americans with little relief.

Burchett’s concerns highlight the tension within the Republican Party between supporting tax cuts and maintaining fiscal responsibility.

Burchett further suggested that the proposed legislation would “slow the rate of growth” of government spending, but he stopped short of endorsing it as a permanent solution to the nation’s fiscal challenges.

While he acknowledged that the bill would curb spending in some areas, he emphasized the need for a more aggressive approach to reducing the national debt.

“I would hope we can slow it to zero and go the opposite direction at some point,” Burchett said. “America’s got to take this serious, or we’re going to become a third world country.”

This comment highlights the urgency with which Burchett and other conservatives view the nation’s fiscal situation. There is a widespread belief among fiscal conservatives that if the United States does not take decisive action to curb its debt, the country could face economic consequences far more severe than any temporary tax cuts or increases in government spending.

The long-term effects of unchecked debt could erode the country’s global standing, increase inflation, and reduce the economic stability that Americans have come to rely on.

Despite Rep. Burchett’s concerns, it’s important to recognize that President Trump’s tax agenda has the potential to usher in a new era of economic growth and prosperity for the American people.

The bill’s primary goal is to make the 2017 corporate tax cuts permanent, which would provide businesses with more certainty and encourage investment in the American economy.

By lowering the corporate tax rate, Trump aims to stimulate job creation, increase wages, and foster a more competitive business environment.

Critics of the tax cuts often argue that they disproportionately benefit the wealthy and large corporations. However, proponents of the bill argue that these tax cuts create a ripple effect throughout the economy, benefiting workers and families in the form of higher wages and more job opportunities.

Lowering corporate tax rates incentivizes businesses to expand and invest in new projects, ultimately creating jobs and boosting economic growth.

The proposed changes to Medicaid spending are also an important aspect of the Trump tax agenda. The bill aims to cut hundreds of billions of dollars in Medicaid spending over the next decade.

While this may sound harsh to some, it’s important to recognize that Medicaid, as it stands, is an inefficient and unsustainable program. The Trump administration’s goal is to reduce wasteful spending, streamline Medicaid, and ensure that the program is more effective in serving those who truly need it.

Medicaid, while providing essential healthcare services to millions of low-income Americans, has also become a major drain on the federal budget. The program’s rising costs have made it difficult for the government to maintain other essential services.

By cutting unnecessary spending and reining in Medicaid’s growth, the Trump administration hopes to create a more sustainable and efficient system that can continue to provide care to those who need it most without burdening taxpayers.

The Senate version of the “big, beautiful bill” represents a significant step forward in Trump’s effort to enact his tax agenda. One of the most notable changes in the Senate version is the proposed increase in the debt ceiling by $5 trillion.

This is a point of contention for Rep. Burchett and other fiscal conservatives, who have expressed concern about the long-term impact of such an increase.

However, it’s important to understand that the debt ceiling increase is a necessary step in ensuring that the U.S. government can continue to meet its financial obligations.

Without an increase in the debt ceiling, the government would face the prospect of defaulting on its debt, which would have catastrophic consequences for the U.S. economy.

By raising the debt ceiling, the Trump administration is ensuring that the U.S. government can continue to operate smoothly and fulfill its obligations. While this is a controversial decision, it is a pragmatic one that recognizes the importance of maintaining the country’s financial stability.

The increase in the debt ceiling will allow the government to continue funding essential services and programs, while also giving policymakers the time and flexibility needed to address the nation’s long-term fiscal challenges.

While the short-term measures in the Trump tax agenda are necessary to ensure the country’s immediate financial stability, the long-term solution to the deficit lies in reducing government spending and reforming entitlement programs like Medicaid.

As Rep. Burchett noted, it is critical to slow the rate of government spending and ultimately begin to reduce the national debt. The Trump administration has already taken steps in this direction by pushing for cuts to Medicaid spending and by focusing on efficiency and transparency in healthcare pricing.

In addition to Medicaid reforms, Trump’s tax agenda includes provisions to phase out renewable-energy tax credits enacted under President Biden. These tax credits have been criticized for propping up inefficient industries that are not contributing to long-term economic growth.

By removing these credits, the Trump administration aims to shift focus toward more sustainable, market-driven solutions that will benefit both the economy and the environment in the long run.

The combination of tax cuts, spending reforms, and fiscal discipline will help to create a more balanced and sustainable federal budget.

While the process will undoubtedly be difficult, the Trump administration’s commitment to reducing wasteful spending and promoting economic growth is essential for the future of the United States.

Rep. Tim Burchett’s concerns about deficit spending are valid, and they reflect a broader concern among Republicans about the long-term sustainability of the nation’s fiscal policies.

However, it is important to recognize that the Trump tax agenda represents a bold path forward for the American economy. By making the 2017 corporate tax cuts permanent, reforming Medicaid, and eliminating inefficient tax credits, President Trump is taking the necessary steps to create a more sustainable and prosperous future for all Americans.

The increase in the debt ceiling and the proposed reforms to Medicaid are essential to maintaining the country’s financial stability, while also allowing for the implementation of the Trump administration’s tax policies.

While these measures may not be popular with everyone, they are necessary to ensure that the U.S. government can continue to meet its obligations and support the American people.

Ultimately, the Trump tax agenda is about more than just cutting taxes or reducing spending. It’s about creating a sustainable, market-driven economy that benefits all Americans.

By embracing these reforms, President Trump can help ensure that the United States remains the world’s preeminent economic power, providing opportunities for all citizens to thrive. It is time for Congress to come together and support this vision for a stronger, more prosperous America.