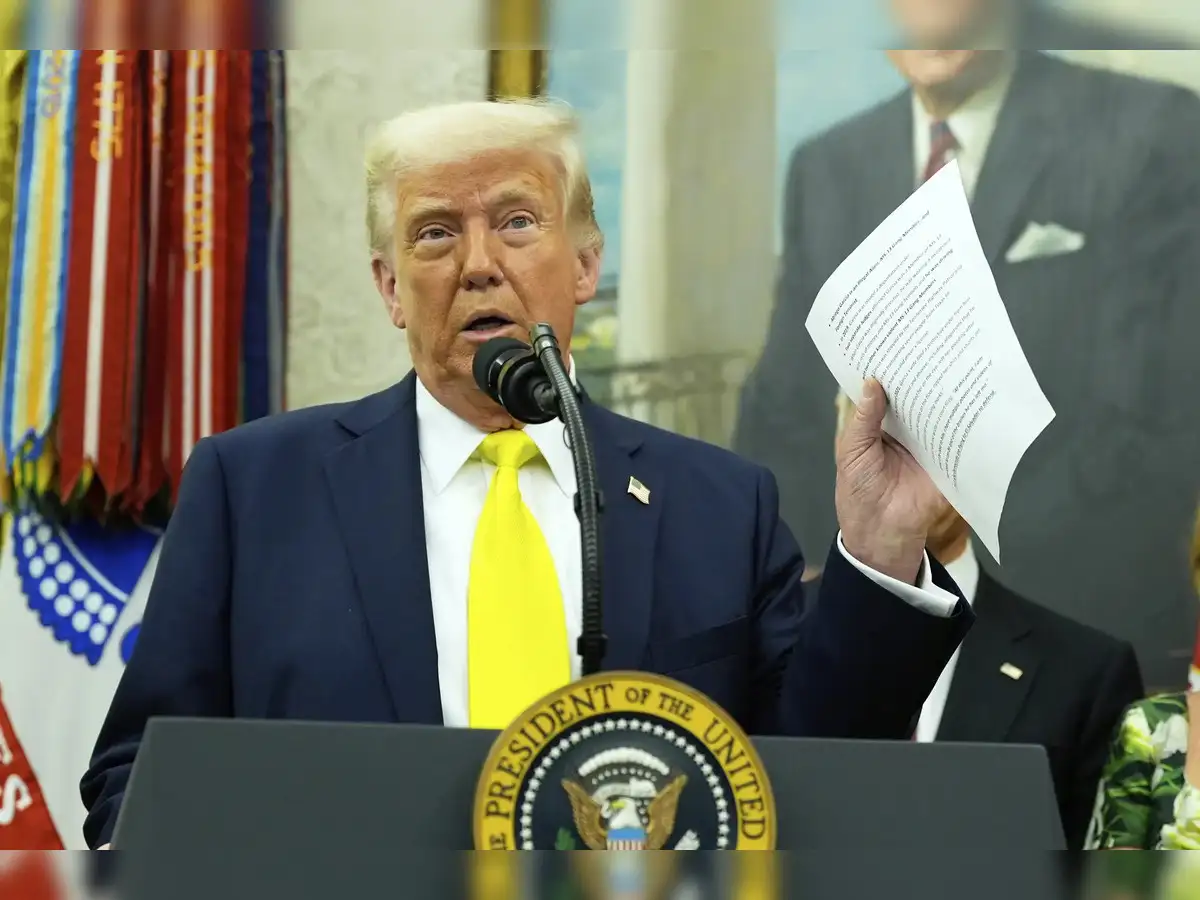

Amidst ongoing political debates, President Donald Trump’s "One Big Beautiful Bill" (OBBB) continues to capture the spotlight as both Republicans and Democrats spar over its potential impact.

While the Congressional Budget Office (CBO) recently released a report under pressure from House Democrats that claims the OBBB would harm low-income households, a deeper dive into the data reveals a different story—one that overwhelmingly benefits the majority of Americans, including the poor, and strengthens the U.S. economy as a whole.

The report, often cited by Democrats, claims that the OBBB would primarily benefit the rich and leave the poorest Americans worse off, particularly due to reductions in Medicaid and food assistance programs.

However, these findings are misleading and do not capture the full picture of what the bill would achieve. In fact, the majority of American households would benefit from the bill’s tax cuts, with the middle class receiving a boost in income and the overall economy benefiting from stronger growth.

The CBO’s report, requested by House Minority Leader Hakeem Jeffries (D-NY) and House Budget Committee ranking member Brendan Boyle (D-PA), breaks down the bill’s effects across different household income deciles.

While the report highlights that the bottom three deciles would face some reductions in benefits, it fails to account for the tax cuts that would impact every household in America.

According to the CBO’s own findings, 70% of households would see an increase in their after-tax and after-transfer income if the bill became law, with the typical middle-class household receiving a $1,000 boost.

Despite this positive outlook, Democrats have seized on the report’s finding that the poorest households could see a reduction in Medicaid and Supplemental Nutrition Assistance Program (SNAP) benefits as a way to argue against the bill.

This narrow focus fails to recognize the broader benefits of the OBBB. While the bill trims the growth of some entitlement programs, it also ensures that Americans have access to greater economic opportunities, which can help reduce dependence on these programs in the long term.

The CBO’s analysis on the poorest households fails to consider several critical factors. First, the CBO assumes that states will cut food stamp spending in proportion to federal reductions, but this is not a given.

States have the flexibility to continue spending at current levels or even increase their investment in social welfare programs, regardless of the federal cuts. This flexibility provides an opportunity for state governments to cushion the blow to low-income families, ensuring that they are not left behind.

Second, the CBO’s analysis assumes that millions of people will lose Medicaid benefits and that they will not take any action to replace or maintain their healthcare coverage.

This assumption is highly flawed, as history has shown that many people who face the loss of public benefits take steps to find alternative solutions, such as securing employment that provides health insurance.

The CBO’s track record on predicting health insurance losses is also questionable. In 2017, it predicted that the repeal of the Affordable Care Act’s individual mandate would cause millions to lose their health insurance.

In reality, the number of people with private health insurance increased by 3 million, while the number of Medicaid recipients grew by 10 million.

Most importantly, the CBO report ignores the macroeconomic consequences of rejecting the OBBB. If Congress does not pass the bill, the result will be a $4 trillion tax hike that would slow economic growth and lead to a recession.

Historically, recessions hit low-income households the hardest, as they are more likely to suffer from job losses and wage stagnation during times of economic downturn.

A recession would not only hurt the poor but also delay or eliminate the opportunity for upward mobility and economic advancement for millions of Americans.

Trump’s tax cuts in 2017 demonstrated the positive impact of pro-growth economic policies. After the Tax Cuts and Jobs Act was passed, wages rose by 5% overall, with the bottom 10% of wage earners seeing 50% more wage growth than the top 10% of earners.

This wage growth was a direct result of lower taxes and deregulation, which allowed businesses to grow, create jobs, and invest in their workers.

The CBO failed to predict this outcome, as it assumed that tax cuts would only benefit the wealthy, when in reality, they resulted in widespread benefits for the entire economy.

The OBBB would continue this trend of tax cuts and economic growth, ensuring that the wealthiest Americans pay a larger share of the federal tax burden while simultaneously providing relief to the middle class.

Before the 2017 tax cuts, the wealthiest 10% of earners paid 70% of federal taxes, and the top 1% paid 38.5%. Under the OBBB, the top 10% would pay 77.5%, and the top 1% would contribute 41.1%.

This redistribution of the tax burden means that the wealthy would continue to pay the majority of federal taxes, while the middle and lower-income households would see their tax burdens reduced.

The goal of the OBBB is not only to provide tax relief but also to prevent the economic stagnation that would result from a $4 trillion tax hike.

By cutting taxes, stimulating economic growth, and ensuring that businesses continue to expand, the OBBB would create an environment where job opportunities, wage growth, and economic prosperity are accessible to all Americans—regardless of income level.

Trump’s approach to tax reform and economic policy has always been centered on the idea that a strong economy benefits everyone. Lower taxes and reduced regulations allow businesses to thrive, create jobs, and invest in American workers.

This economic philosophy is grounded in the belief that prosperity is best achieved when the government gets out of the way and allows the private sector to flourish. The OBBB is a continuation of this vision, ensuring that the American people are empowered to achieve success on their own terms.

In addition to its economic benefits, the OBBB would also promote greater national security by providing additional resources to federal agencies tasked with protecting the country.

The bill’s passage would allow for increased funding for law enforcement, border security, and national defense, which are essential components of maintaining the safety and security of the American people.

Trump has consistently advocated for a strong military and law enforcement presence to deter threats to the U.S. and ensure that the country remains safe from both domestic and foreign adversaries.

The OBBB represents a win for everyone—regardless of political affiliation. While Democrats continue to focus on the purported negatives of the bill, such as cuts to entitlement programs, they fail to acknowledge the larger economic benefits that the OBBB would bring.

By cutting taxes, promoting economic growth, and ensuring that the wealthiest Americans contribute a larger share of the tax burden, the OBBB is a victory for all Americans.

In conclusion, the One Big Beautiful Bill is a bold and necessary step toward ensuring that America remains strong, prosperous, and secure. While the Democrats may latch onto misleading reports from the CBO, the reality is that the bill will benefit the vast majority of American households, particularly the middle class.

By reducing taxes, stimulating economic growth, and ensuring that the wealthiest Americans pay their fair share, the OBBB represents the best path forward for America.

This bill is not only about cutting taxes—it's about ensuring that the American people have the tools and resources they need to thrive in a rapidly changing world. Trump’s vision of a strong, prosperous America is one that will benefit everyone, and the passage of the OBBB is a crucial step in achieving that vision.