When the Trump administration announced this week that it was widening its steel and aluminum tariffs, analysts warned that the ripple effects could soon show up in everyday purchases.

Items as ordinary as tableware, motorcycles, and even children’s products may carry higher price tags as a result of the new measures.

The expansion, which officially took effect on Monday, adds roughly 400 additional goods to the list of imports subject to a 50% tariff.

These new levies build upon the steel and aluminum tariffs first imposed in March, dramatically broadening their reach.

Among the items swept into this latest round of duties are air-conditioning units, space heaters, high chairs, knives, and select furniture products.

The net effect is simple: if a consumer good contains any significant portion of steel or aluminum, there is now a strong chance it falls under the tariff umbrella.

“Basically, if it’s shiny, metallic, or remotely related to steel or aluminum, it’s probably on the list,” said Brian Baldwin, vice president of customs at logistics firm Kuehne + Nagel International AG, in a widely shared LinkedIn post.

His remark captures both the breadth and bluntness of the expansion—tariffs are no longer limited to raw steel coils or aluminum sheets but now touch products visible in kitchens, garages, and playrooms across America.

The U.S. Commerce Department moved quickly to frame the policy as a strategic intervention, not a punitive burden. In a statement issued Tuesday, Jeffrey Kessler, Under Secretary of Commerce for Industry and Security, argued that the broader tariffs were necessary to close loopholes.

Importers, he said, had been working around earlier tariffs by sourcing products that were partially processed abroad or assembled in ways that diluted their classification as steel or aluminum goods.

“Today’s action expands the reach of the steel and aluminum tariffs and shuts down avenues for circumvention – supporting the continued revitalization of the American steel and aluminum industries,” Kessler said.

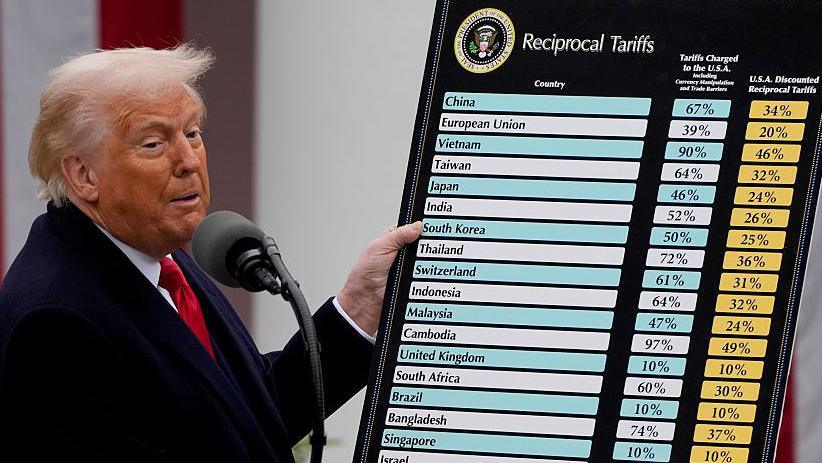

This justification taps into a longstanding Trump theme: that foreign producers, especially those in Europe and Asia, have been exploiting trade loopholes and undercutting U.S. manufacturers.

The expansion, the administration insists, is meant to level the playing field and restore the competitiveness of American industry.

The natural question, however, is what this means for American shoppers. Historically, import tariffs translate into higher retail prices, as businesses pass the tax burden down the supply chain.

While some companies may absorb part of the cost in the short run, few can sustain it indefinitely.

So far, economists note, tariff-driven inflation has been relatively muted. The U.S. inflation rate currently stands at 2.7%, actually lower than the 3% rate in January, just before Trump assumed office.

This suggests that despite widespread fears of consumer pain, the impact has either been absorbed by retailers or offset by broader economic trends.

But that could change. This week’s expansion dramatically increases the scope of coverage. According to Jason Miller, a professor of supply chain management at Michigan State University, the tariffs now apply to $320 billion worth of products, up from $190 billion before the new expansion.

That scale alone increases the likelihood that costs will trickle down to shoppers, especially as more everyday consumer goods get caught in the tariff net.

“These tariffs will definitely affect U.S. manufacturers,” Miller explained. “The added costs could filter their way into higher consumer prices.”

One important detail is that the 50% tariff applies specifically to the proportion of a product made of steel or aluminum. Take, for example, a steak knife manufactured in Germany.

Under the new rules, the steel content would face a 50% tariff, while the non-steel portion of the knife would instead fall under a 15% universal levy applied to goods from the European Union.

This layered approach makes the tariff regime complex and variable, depending on both the product and its country of origin. Auto parts, construction equipment, and farming machinery—essential inputs for American businesses—are now in the crosshairs.

That means the tariffs are not just about consumer products on shelves, but also about the raw materials and components that underpin domestic manufacturing and agriculture.

At the heart of the debate lies a fundamental trade-off. Proponents argue that tariffs protect American jobs, revive domestic factories, and bolster national security by ensuring the U.S. can produce its own critical materials.

Critics counter that tariffs function as a tax on consumers, raising prices and distorting market efficiencies.

Supporters of the Trump approach point to signs of revitalization in steel and aluminum production. Plants in states like Ohio and Pennsylvania have restarted operations, and domestic producers claim they are finally able to compete against cheaper imports from China and Europe.

Opponents, however, warn that the broader economy may pay the price. If manufacturing inputs become more expensive, U.S. producers could lose competitiveness in global markets.

Farmers, automakers, and construction companies—industries that rely heavily on imported machinery and parts—may find themselves squeezed.

The expansion of tariffs also risks fueling international trade tensions. The European Union has already expressed displeasure at the levies imposed on goods from its member states.

Germany, in particular, could feel the pinch, given its robust exports of tools, machinery, and vehicles. Retaliatory measures remain possible, raising the specter of a tit-for-tat escalation that could affect unrelated sectors such as agriculture, aviation, or luxury goods.

Meanwhile, China has long been the primary target of U.S. tariffs. While the new measures are broader and affect multiple trading partners, Beijing may see the expansion as a reinforcement of Trump’s hardline stance.

Analysts suggest this could complicate ongoing negotiations over intellectual property, market access, and supply chain security.

Tariffs are not new to American policy. From the 19th century to the Smoot-Hawley Act of the 1930s, the U.S. has often used tariffs as a tool to shield domestic industry. Trump’s approach, however, is notable for its scale, speed, and political framing.

Unlike previous administrations, which largely embraced free trade under the World Trade Organization framework, Trump has consistently portrayed tariffs as weapons of sovereignty.

He has argued that America’s economic independence requires the ability to protect its industries, even if that means higher consumer prices in the short term.

This framing turns tariffs into more than just a fiscal tool—it recasts them as a symbol of national strength. “Pay a little more today, build a stronger democracy tomorrow,” as Trump has often implied, captures this ethos.

The key question is whether this gamble pays off. If tariffs genuinely lead to a resilient domestic steel and aluminum industry, the higher prices may be justified.

A thriving industrial base can mean secure jobs, stable supply chains, and reduced dependence on foreign powers—an especially important consideration in a world marked by geopolitical rivalries.

On the other hand, if the tariffs merely raise costs without leading to lasting industrial growth, consumers may be left footing the bill for little return.

Critics argue that global supply chains are too entrenched, and that trying to “re-shore” industries may prove far more expensive than anticipated.

For now, shoppers may only notice modest increases: a slightly pricier kitchen knife, a bump in the cost of a child’s high chair, or a more expensive motorcycle. But as the tariffs extend deeper into supply chains, the cumulative impact could grow.

For manufacturers, the changes are immediate and significant. The costs of imported machinery, farming tools, and auto parts are climbing, and businesses will need to decide whether to absorb those costs, cut jobs, or pass them on to consumers.

The political stakes are equally high. Trump has staked his economic agenda on the belief that tariffs can both rebuild industry and resonate with working-class voters in manufacturing states.

If inflation remains manageable and factory jobs return, he will have a powerful argument heading into the next election cycle. If not, critics will seize on the tariffs as proof of economic mismanagement.

The Trump administration’s decision to expand steel and aluminum tariffs to 400 new products marks a major escalation in U.S. trade policy.

While the move is framed as a defense of American industry, it carries significant risks of higher consumer prices, strained supply chains, and international backlash.

As one analyst put it: “If it’s shiny, metallic, or remotely related to steel or aluminum, it’s probably on the list.” That means the effects of this policy will not remain abstract.

The coming months will reveal whether this bold tariff strategy delivers the long-term revitalization the administration promises—or whether it leaves Americans paying more at the checkout counter without seeing the benefits at home.